The transaction highlights growing pressure on crypto treasury companies to prioritize debt reduction as token prices remain volatile.

Crypto treasury company ETHZilla said in a filing with US regulators that it sold part of its Ether holdings to repay outstanding convertible notes amid a broader market downturn.

The company disclosed in a filing with the Securities and Exchange Commission the sale of 24,291 Ether

for $74.5 million at an average price of $3,068.69 per token, leaving about 69,800 ETH on its balance sheet as of Friday.

The company said it expects to use all or a significant portion of the proceeds to redeem its outstanding senior secured convertible notes.

ETHZilla rebranded from 180 Life Sciences Corp on July 29, pivoting away from biotechnology to an Ether-focused investment strategy. Until then, the former clinical-stage biotech had seen its shares fall more than 99.9% since going public in 2020.

The news comes after ETHZilla announced two acquisitions in December, taking a 20% fully diluted stake in automotive-finance AI startup Karus and a 15% stake in digital housing lender Zippy.

The former biotech company’s stock closed the trading session declining 8.7% on Monday and is down more than 65% year-to-date, according to Google Finance data.

Source: Google Finance

Related: Metaplanet clears issuance of dividend-paying shares for overseas institutions

Digital asset treasuries reposition as prices drop

In September, Cointelegraph reported that publicly traded companies have sharply increased their Bitcoin

exposure this year. Data from BitcoinTreasuries.NET shows that more than 190 listed companies now hold Bitcoin on their balance sheets, with combined holdings exceeding 5% of Bitcoin’s circulating supply in September.

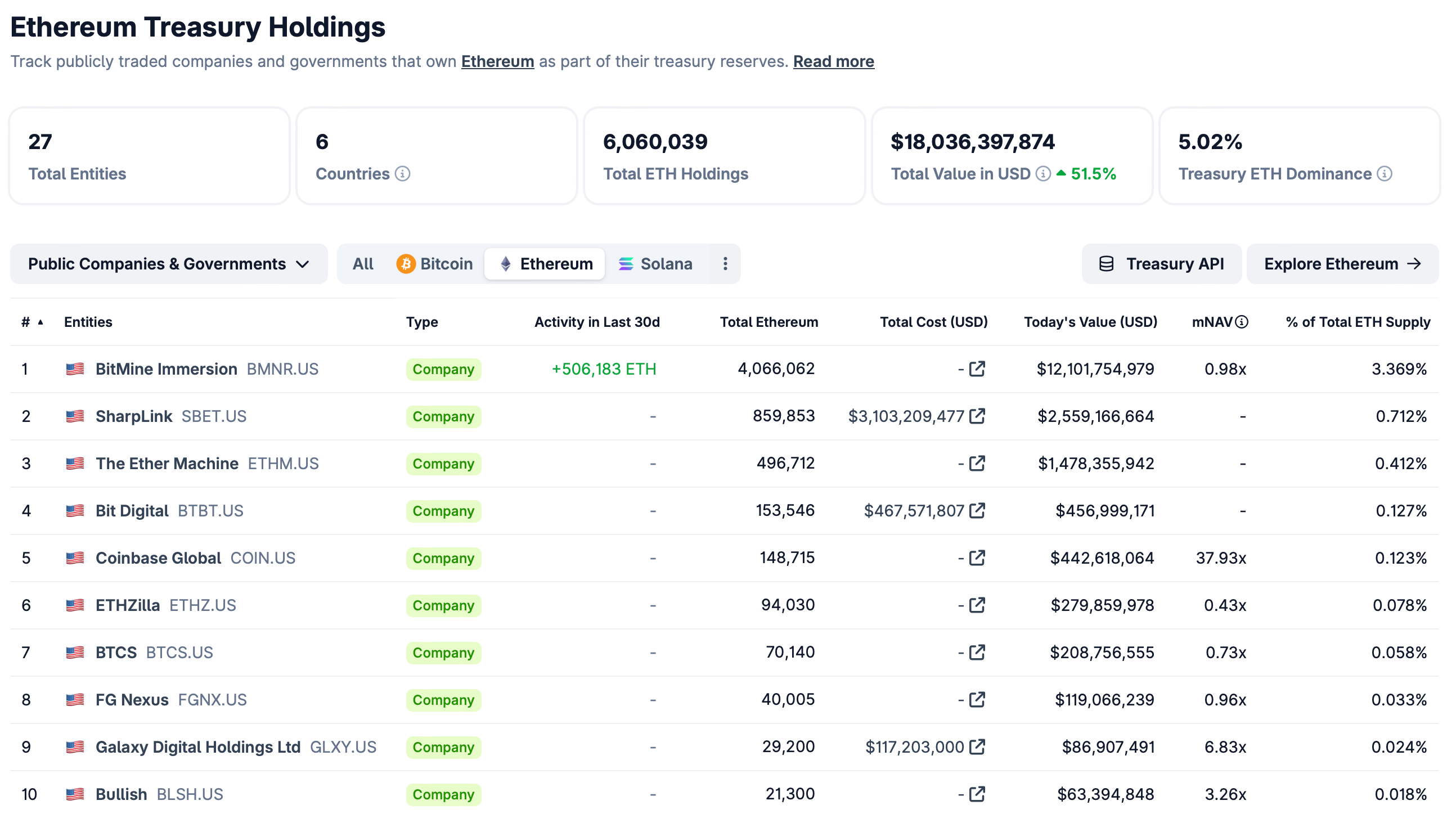

Ether has gauged similar demand from investors. According to CoinGecko data, 27 public companies collectively hold about 6 million ETH, also representing about 5% of the token's circulating supply.

Ether Treasury Holdings. Source: CoinGecko

With Bitcoin retreating from its Oct. 6 record high of $126,000 and weakness spreading across altcoins including Ether, some digital-asset treasury companies are selling assets to strengthen their balance sheets.

In late October, Ether treasury company FG Nexus began selling its coins to fund a share repurchase program, liquidating 10,922 ETH alongside a separate debt draw to accelerate buybacks. The proceeds were used to support the repurchase of approximately 3.4 million shares at an average price of about $3.45 per share.

In November, Sequans Communications said it redeemed 50% of its outstanding convertible debt using proceeds from the sale of 970 Bitcoin. The transaction reduced total debt to $94.5 million and cut the company’s Bitcoin holdings to 2,264 BTC, down from 3,234 BTC.

On Friday, Strategy, the first public company to adopt a Bitcoin treasury strategy, said it sold 4.535 million shares of Class A stock between Dec. 15 and Dec. 21, raising $747.8 million to its cash reserves as it navigates the crypto downturn.