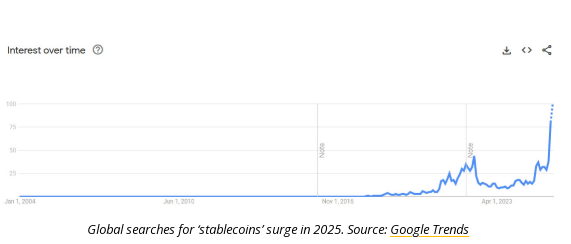

Stablecoin searches reached an all-time high on Google as market cap topped a record $270 billion following passage of the GENIUS Act.

Google search data shows interest in stablecoins surged to an all-time high this month as regulations were greenlit, stablecoin issuance and supply skyrocketed, and institutions increasingly look to launch their own tokenized fiat equivalents.

The previous peak for stablecoin searches was in May 2022, just after the depeg of the Terra (USTC) algorithmic stablecoin and the collapse of the Luna ecosystem.

More recent data shows search interest surged in mid-June and then again in mid-July following the passing of the Guiding and Empowering Nation’s Innovation for US Stablecoins (GENIUS) Act into law on July 18.

“People are waking up to their potential,” commented crypto analyst “The DeFi Investor” on X, adding:

“Stablecoins are the product that can onboard the first billion people on-chain.”

Global searches for ‘stablecoins’ surge in 2025. Source: Google Trends

Parabolic stablecoin growth

Crypto asset management firm Bitwise said on X that “stablecoins are going parabolic” on Monday as both stablecoin market capitalization and transactions have surged to record levels this year.

“You can’t spell ‘stablecoins’ without ‘parabolic’,” quipped Ethereum treasury firm SharpLink.

Stablecoin total market capitalization is at a record high of $272 billion, which equates to around 7% of the total crypto market capitalization, according to CoinGecko.

Related: Lightning Network could nab 5% of stablecoin flows by 2028: Voltage CEO

Of this total, around 98% are stablecoins pegged to the US dollar, and Tether is the market-dominant issuer with a share of 60%.

Global searches for ‘stablecoins’ surge in 2025. Source: Google Trends

Parabolic stablecoin growth

Crypto asset management firm Bitwise said on X that “stablecoins are going parabolic” on Monday as both stablecoin market capitalization and transactions have surged to record levels this year.

“You can’t spell ‘stablecoins’ without ‘parabolic’,” quipped Ethereum treasury firm SharpLink.

Stablecoin total market capitalization is at a record high of $272 billion, which equates to around 7% of the total crypto market capitalization, according to CoinGecko.

Related: Lightning Network could nab 5% of stablecoin flows by 2028: Voltage CEO

Of this total, around 98% are stablecoins pegged to the US dollar, and Tether is the market-dominant issuer with a share of 60%.