Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

Today in crypto, JPMorgan moves to accept crypto ETFs as loan collateral, Sygnum warns of looming Bitcoin supply squeeze, and Trump-linked wallet sparks confusion after family denies involvement.

JPMorgan to accept crypto ETFs as collateral for loans — Report

JPMorgan, the largest bank in the United States by assets, plans to offer trading and wealth-management clients the option of using crypto-linked assets as collateral for loans, according to a June 4 report from Bloomberg.

The bank is set to allow financing against crypto exchange-traded funds (ETFs) in some weeks. JPMorgan will begin with BlackRock’s iShares Bitcoin Trust, which, according to Sosovalue.com, is the largest US spot Bitcoin (BTC) ETF with $70.1 billion in net assets.

The bank will also consider clients’ crypto holdings when assessing net worth, treating digital assets similarly to traditional ones when determining how much a client can borrow against assets.

JPMorgan is among US banks betting on crypto initiatives for some of its clients. In 2020, it launched JPM Coin, a dollar-pegged stablecoin and in 2024, the bank reported holding shares of different spot Bitcoin ETFs.

Bitcoin’s shrinking supply may trigger price breakout: Sygnum

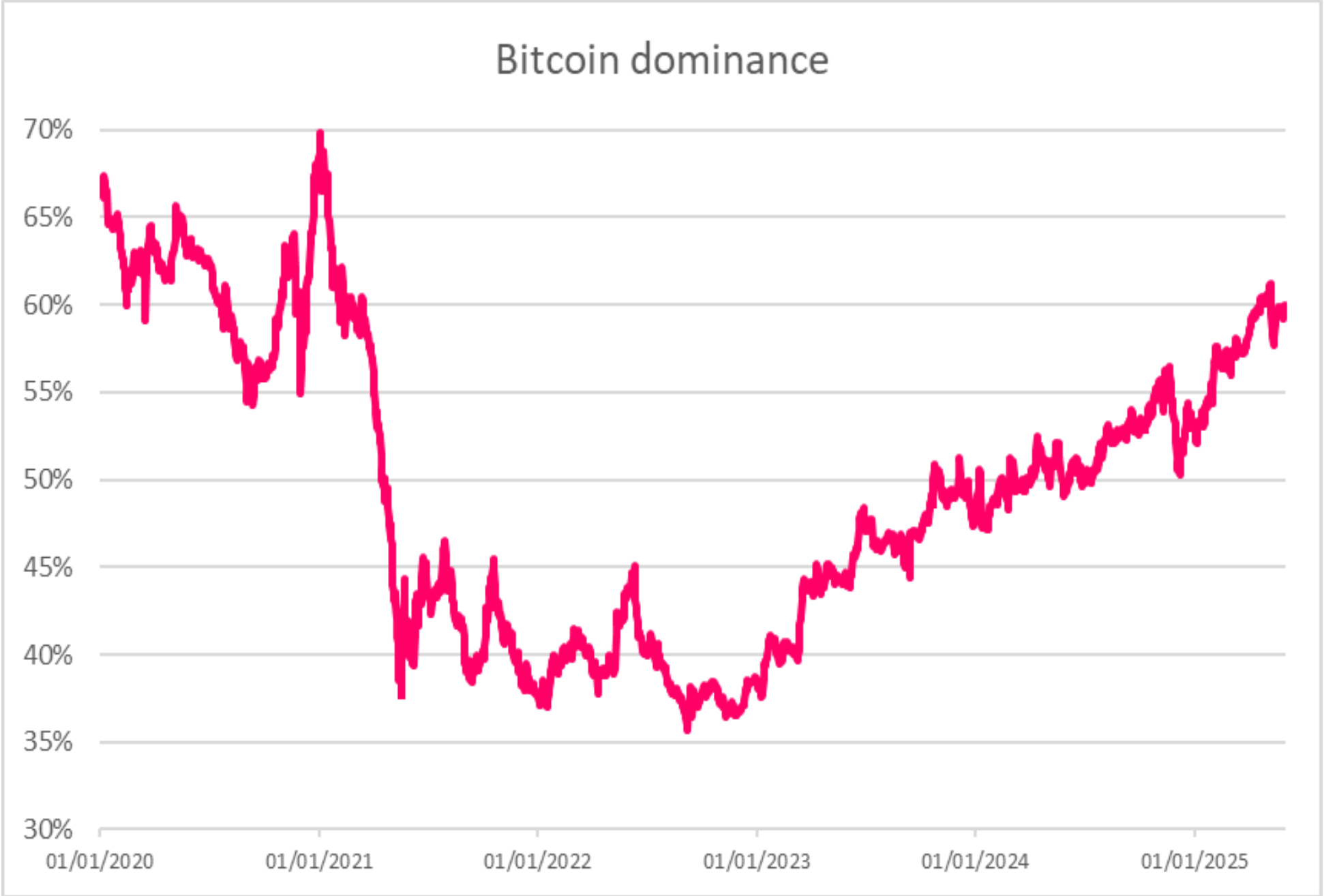

Bitcoin’s circulating supply is tightening fast, setting the stage for potential price surges as demand continues to grow, according to Sygnum Bank’s June 2025 Monthly Investment Outlook.

Advertisement

Start Your Crypto Journey with Coinbase! Join millions worldwide who trust Coinbase to invest, spend, save, and earn crypto securely. Buy Bitcoin, Ethereum, and more with ease!

Sygnum analysts noted that Bitcoin’s

liquid supply had dropped by 30% over the past 18 months, primarily driven by institutional adoption and the rise of Bitcoin acquisition vehicles.

These entities, including exchange-traded funds (ETFs) and corporate buyers, have steadily withdrawn coins from exchanges, a move typically seen as bullish.

“Bitcoin’s fast-shrinking liquid supply is creating the conditions for demand shocks and upside volatility,” the report said.

Since late 2023, Bitcoin balances on exchanges have fallen by about 1 million BTC. The trend is accelerating as a growing number of funds issue equity or debt to purchase Bitcoin, further soaking up available supply.

At the same time, geopolitical and fiscal uncertainties, particularly around the weakening US dollar and ballooning US debt, drive investors toward crypto markets.

Bitcoin dominance. Source: Sygnum

Adding to the momentum, three US states recently passed legislation permitting Bitcoin reserves. New Hampshire has already signed such a bill into law, with Texas likely to follow.

Meanwhile, international interest is growing. Sygnum highlighted that Pakistan’s government and Reform UK, the party currently leading in UK election polls, have announced intentions to explore Bitcoin reserve strategies.

Trump wallet announcement spirals into confusion

A June 3 announcement of a Trump-branded crypto wallet to be launched by a business linked to the Trumps became muddled after US President Donald Trump’s sons distanced the family from it.

Non-fungible token (NFT) marketplace Magic Eden and the firm behind the president’s memecoin that is linked to his sprawling holding company, the Trump Organization, said they were linking up to launch the “Official $TRUMP Wallet by President Trump.”

But the president’s sons, Eric, Barron and Donald Trump Jr., all said they knew “nothing about it” and that the Trump Organization has “zero involvement” with the product. Donald Trump Jr. then added the family’s crypto platform, World Liberty Financial, “will be launching our official wallet soon.”

Source: Donald Trump Jr.

Crypto skeptic Molly White said the saga was “absolute chaos” and speculated a breakdown in communication between the various Trump-linked businesses.

The Trump Wallet website said the project is a partnership with Magic Eden and GetTrumpMemes.com — the latter is owned by Fight Fight Fight LLC, which is co-owned by a company affiliated with the Trump Organization called CIC Digital LLC. Those two companies together own a majority of the supply of Trump’s memecoin.