Ether continued dominating ETP inflows last week despite Bitcoin printing new highs above $124,000 and ETH only nearing all-time highs.

Cryptocurrency investment products saw another week of strong inflows, largely driven by Ether exchange-traded products (ETPs).

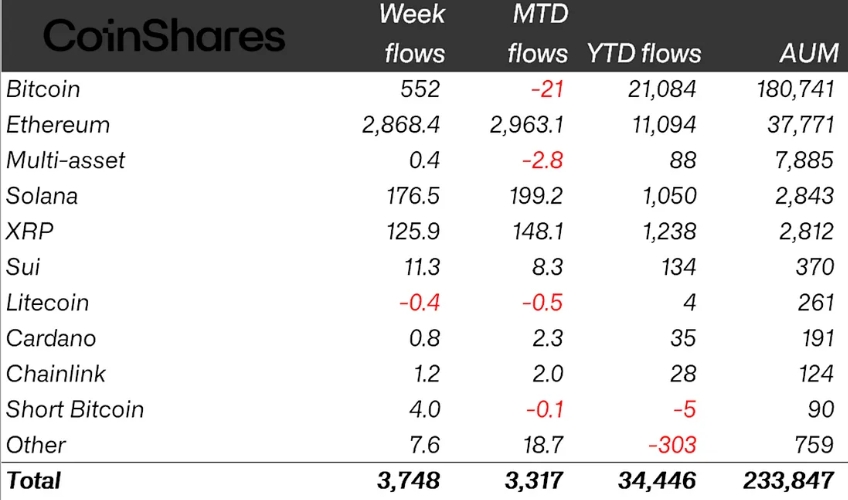

Global crypto ETPs posted $3.75 billion of inflows during the trading week ending Friday, European crypto asset manager CoinShares reported on Monday.

The inflows came amid strong bullish momentum for Ether

, with prices nearing all-time high levels above $4,700 on Thursday, according to CoinGecko data.

After four days of inflows, however, investor sentiment shifted to red, with both Bitcoin

and Ether funds seeing outflows on Friday, according to SoSoValue.

Bitcoin ETPs see modest inflows despite ATH above $124,000

Despite Bitcoin surging above $124,000 on Wednesday, BTC failed to drive massive ETP gains last week, with inflows totaling $552 million, or about 15% of total weekly inflows.

Ether topped last week’s gains with inflows totaling $2.9 billion, marking growing investor appetite for the altcoin ETP.

Crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinShares

Solana

and XRP

saw inflows of $176.5 million and $125.9 million, respectively. Litecoin

and Toncoin

saw outflows of $0.4 million and $1 million, respectively.

Highest trading volume week ever

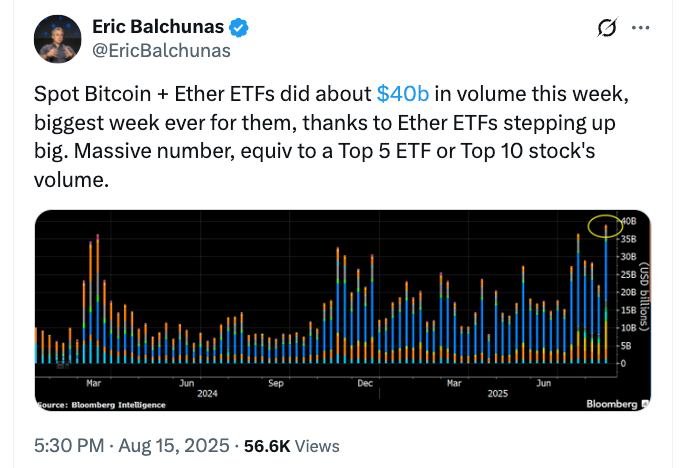

According to Bloomberg ETF analyst Eric Balchunas, last week marked the highest trading volume week ever seen by spot crypto exchange-traded funds (ETFs).

After just four trading days last week, spot Bitcoin and Ether ETFs reached $40 billion in trading volume, largely driven by “Ether ETFs stepping up big,” Balchunas wrote on X on Friday.

Related: Ether accumulation heats up: $882M in ETH snapped up by Bitmine, whale

“ETHSANITY: Ether ETFs weekly volume was about $17 billion, blowing away record, man did it wake up in July,” he said.

Source: Eric Balchunas

NovaDius president Nate Geraci also took to X to highlight the trading volume records, observing that spot Ether ETFs “absolutely obliterated previous weekly trading volume record.”

“Wonder if there are any ‘no demand’ naysayers still out there,” he added.

Inflow streaks go shorter

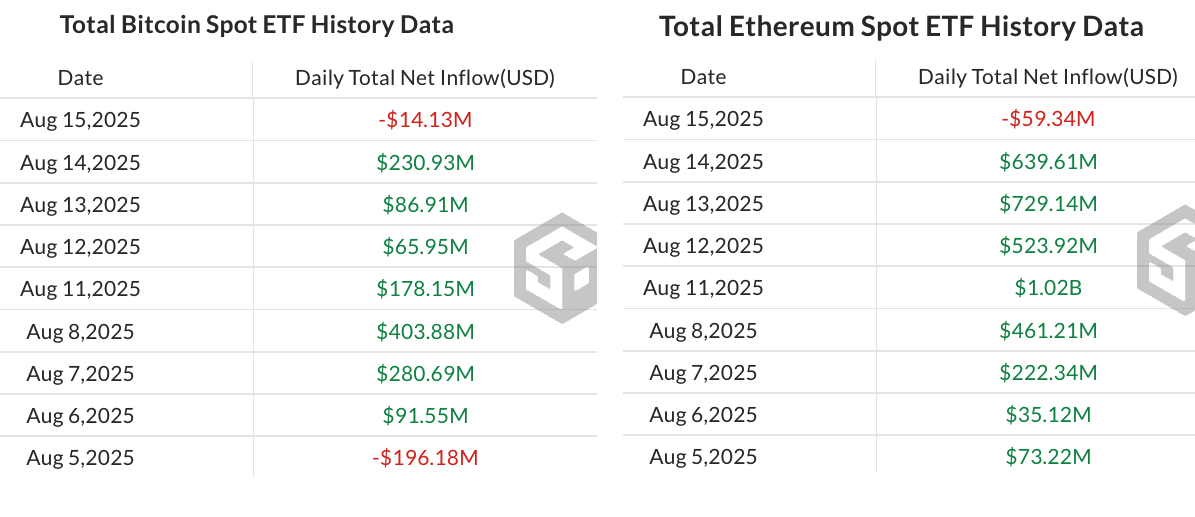

With Ether dominating spot ETF inflows in the past few weeks, the streaks of consecutive inflows in crypto funds have been getting shorter.

According to SoSoValue data, spot Ether ETFs have attracted a total of $3.7 billion of inflows in the latest eight-day inflow run since Aug. 5.

Bitcoin ETFs saw a shorter inflow run, generating just about $1.3 billion in a streak that lasted only seven days.

Total spot Bitcoin and Ether ETF flows since Aug. 5. Source: SoSoValue

The shorter inflow runs contrast with the 20-day streak for Ether in July and a 15-day inflow run for Bitcoin ETPs in June.