According to SaylorTracker, MicroStrategy is up over 65% all-time on its Bitcoin investment and is trading at a net asset value of 1.73x.

MicroStrategy announced the pricing of its perpetual strike preferred stock offering at a public listing price of $80 per share and will issue the corporate securities on Feb. 5.

The company forecasts $563.4 million in revenue from the tranche of perpetual strike preferred stock, which features an 8% coupon and a liquidation value of $100.

According to the announcement, the proceeds from the sale will go toward acquiring more Bitcoin and covering operating expenses.

MicroStrategy continues to lean into its “21/21” plan of issuing $21 billion in equity and $21 billion in fixed-income securities to finance Bitcoin acquisitions, and it has become the most prominent BTC-holding firm.

Related: Buy Bitcoin, stock price goes up 80%: Rumble follows ‘MicroStrategy’ strategy

MicroStrategy strengthens balance sheet

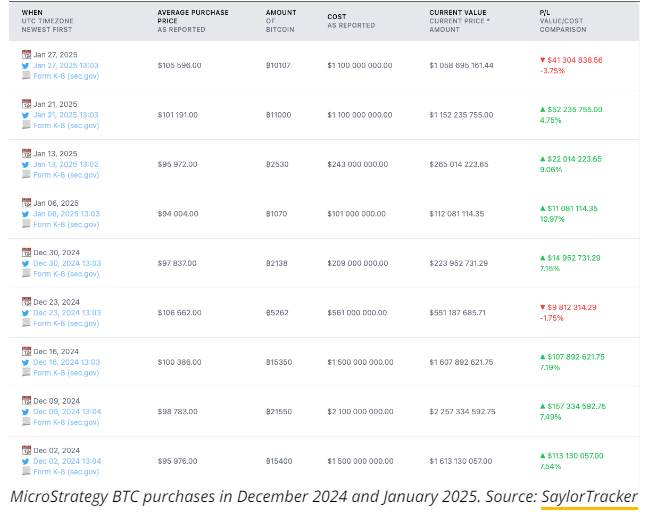

On Jan. 27, MicroStrategy chairman Michael Saylor announced that the company had purchased an additional 10,107 BTC for roughly $1.1 billion.

Data from SaylorTracker shows the company currently has 471,107 BTC, valued at approximately $49.4 billion, with unrealized gains of over $19 billion.

MicroStrategy also announced a debt buyback on Jan. 24, issuing a redemption notice for its 2027 convertible senior note tranche, valued at $1.05 billion.

Holders of the notes have until Feb. 24 to redeem their shares at 100% of the principal price or convert the notes to MicroStrategy stock.

MicroStrategy fights back against corporate alternative minimum tax

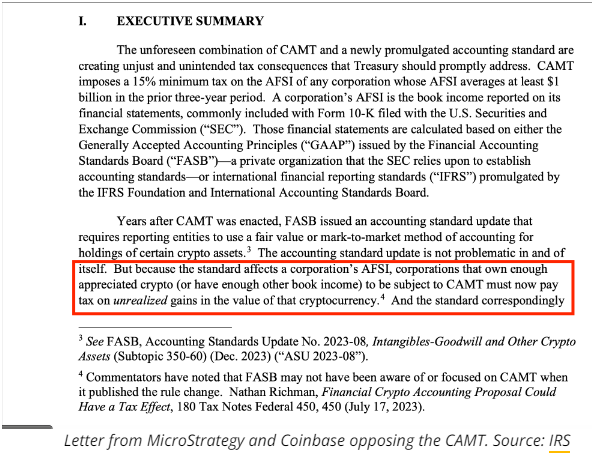

MicroStrategy and Coinbase sent a letter to the US Internal Revenue Service (IRS) on Jan. 2, arguing against the corporate alternative minimum tax (CAMT).

The tax rule imposes a 15% tax on companies with an adjusted financial statement income in excess of $1 billion when averaged over a three-year period.

This minimum alternative tax, coupled with a change in accounting methods, would essentially tax crypto firms on unrealized gains from their digital asset holdings, the letter argued.

Both firms urged the IRS to change the wording of the rule to exclude unrealized gains and losses on investments that are priced at fair value for bookkeeping purposes.

If the rule is not rescinded, MicroStrategy says it may face billions in taxes on its BTC holdings, despite never selling any.