ARK Invest-backed Quantum Solutions is now the largest Ether treasury outside of the US and has a 100,000 ETH treasury target.

ARK Invest-backed Quantum Solutions has emerged as the largest Ether digital asset treasury outside of the United States after accumulating $9 million worth of ETH in a week.

Quantum Solutions’ founder, Francis Zhou, announced the company’s latest Ether

purchase on Thursday.

“I’m proud to announce that we have accumulated 2,365 ETH in just seven days, officially making Quantum Solutions the largest ETH DAT outside the US,” said Zhou, adding that more Ether buys were coming.

The company said it has become Japan’s leading publicly listed Ether DAT and the 11th-largest globally, citing figures from CoinGecko.

Quantum Solutions also has a small Bitcoin

treasury, holding 11.6 BTC worth $1.3 million.

Last week, Zhou said that the firm was acquiring ETH at the rate of 150 million yen ($983,000) per day, “and will continue to accelerate accumulation.”

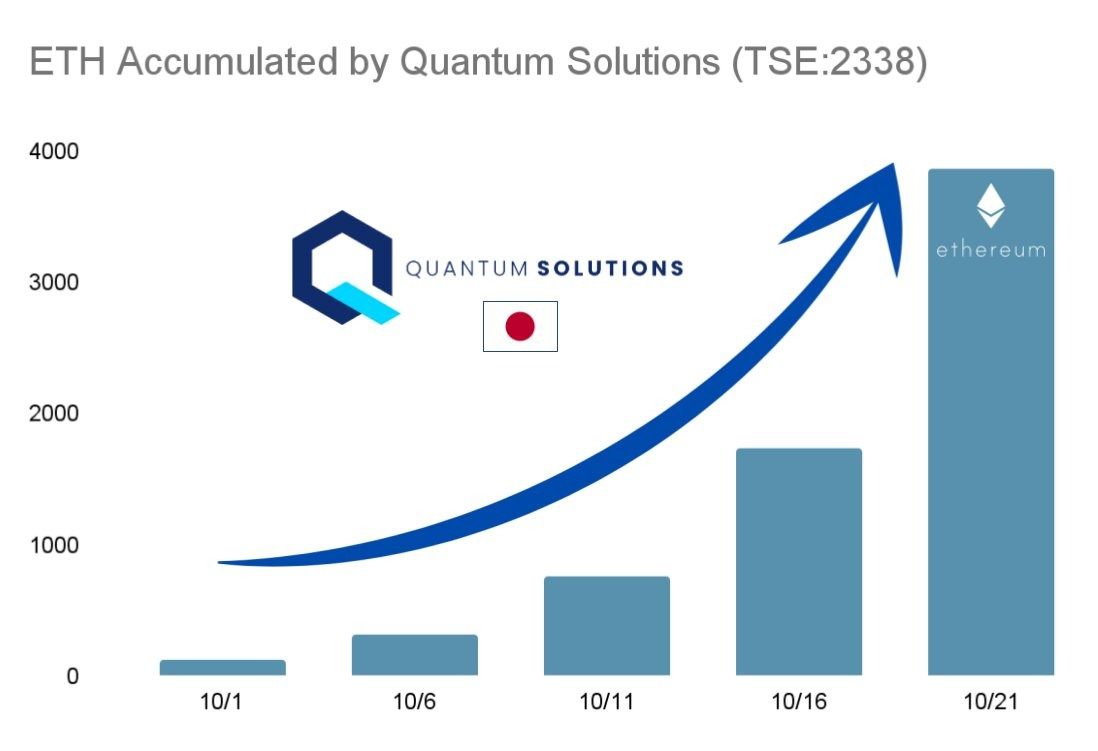

The firm currently holds 3,866 ETH worth around $14.8 million, according to its website.

Quantum Solutions has accumulated $9 million worth of Ether in a week. Source: Francis Zhou

ARK Invest backs ETH treasuries

The Tokyo stock exchange-listed firm raised $180 million in late September to build a 100,000 ETH treasury and was backed by venture firms including ARK Invest and Susquehanna International Group.

Japan remains open to publicly listed DATs, but other stock exchanges in the region, including Hong Kong, India and Australia, have started clamping down on them.

“Three months into the DAT revolution, we’re happy to support Japan’s first institutional-grade ETH DAT,” ARK Invest founder and CEO Cathie Wood said on Thursday.

ARK Invest also invested in Tom Lee-chaired BitMine this year, which is the world’s largest Ether DAT. It first added the firm’s stock to its three innovation and fintech funds in September.

Related: BitMine’s Lee says Ether’s ‘price dislocation’ is a signal to buy

DAT momentum cools

However, the digital asset treasury hype appears to be fading as share prices for some of the world’s largest crypto hoarders have slid in recent weeks.

Last week, Tom Lee questioned whether the DAT bubble had burst, while researchers at 10x Research said, “The age of financial magic is ending for Bitcoin treasury companies.”

However, Lee has been aggressively buying the dip following the record crypto market crash earlier this month.