Despite BTC’s price falling below $80,000 last week, Strategy’s latest BTC buy was the smallest ever announced by the firm.

Michael Saylor’s Strategy, the world’s largest public corporate Bitcoin holder, has announced its smallest Bitcoin purchase on record.

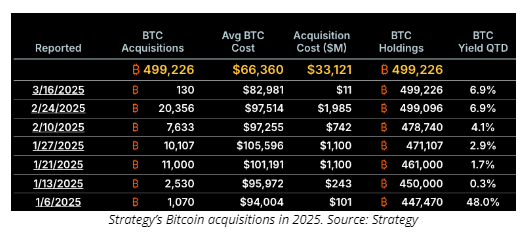

Strategy on March 17 officially announced its latest 130-Bitcoin acquisition, bought for around $10.7 million in cash, or at an average price of roughly $82,981 per BTC.

The latest Bitcoin purchase was made using proceeds from the “STRK ATM,” a new Strategy program looking to raise up to $21 billion in fresh capital to acquire more BTC.

Strategy’s new 130-BTC buy is the smallest one ever recorded since the company announced its first purchase of 21,454 BTC for $250 million in August 2020.

Strategy is 774 BTC away from holding 500,000 BTC

With the new purchase, Strategy and its subsidiaries now hold 499,226 BTC, acquired at an aggregate purchase price of approximately $33.1 billion and an average purchase price of around $66,360 per BTC, including fees and expenses.

After purchasing 130 BTC, Strategy still needs to acquire 774 BTC to reach a total holding of 500,000 BTC.

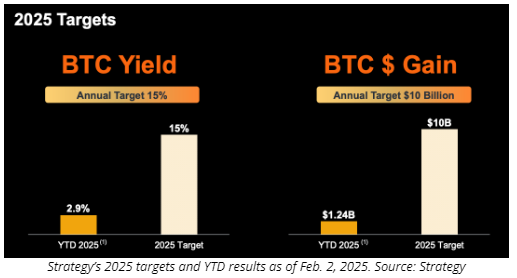

According to the Strategy website, the company’s Bitcoin yield now stands at 6.9%, significantly lower than its 15% target for 2025.

Smallest buy on record

Despite Bitcoin’s price falling to multimonth lows below $80,000 last week, Strategy’s latest buy is significantly smaller than its most recent purchases, making it the smallest ever announced BTC purchase by the firm.

Related: Strategy shares down 30% since Saylor’s Forbes cover

Prior to the latest purchase, the smallest BTC purchase by Strategy was a 169-BTC purchase in August 2024, according to official records by Strategy.

So far in 2025, Strategy has acquired 51,656 BTC in seven announced acquisitions.

Strategy’s “BTC $ Gain” indicator is 74% away from yearly targets

After spending roughly $4.4 billion on its seven Bitcoin purchases in 2025, Strategy recorded a BTC gain value versus the dollar of $2.6 billion year-to-date.

Strategy’s “BTC $ Gain” indicator, which tracks the dollar value of BTC gain calculated based on the market BTC price in a certain period, is now 74% away from the company’s target of $10 billion in 2025.

By the end of 2024, Strategy’s BTC $ Gain reached $13.8 billion, while the Bitcoin yield hit a massive 74%.