Etherscan data shows that an average swap costs only $0.39 in fees compared to around $86 one year ago.

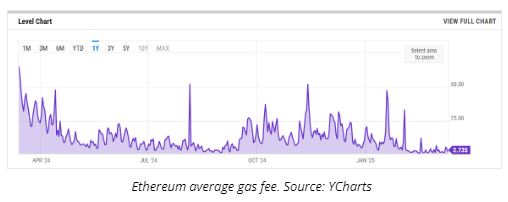

The average Ethereum gas fee has dropped by 95% in the year following the Dencun upgrade, one of Ethereum’s most significant network improvements.

On March 13, 2024, Ethereum’s Dencun upgrade was rolled out. The upgrade combined the Cancun upgrade on the execution layer and the Deneb upgrade on the consensus layer. It also introduced nine Ethereum Improvement Proposals (EIPs).

The primary goal was to enhance Ethereum’s scalability and reduce transaction costs for layer-2 networks. According to YCharts data, Ethereum’s average gas fee has fallen from 72 gwei in 2024 to just 2.7 gwei as of March 12, 2025.

Last year, an average swap cost users $86 in fees, while non-fungible token sales averaged $145 in gas fees. At the time of writing, Etherscan data showed that an average swap would cost $0.39, while an NFT sale would average $0.65.

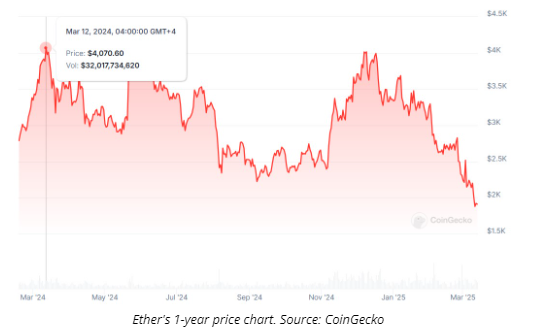

Ether price has dropped 53% since the Dencun Upgrade

Despite the sharp drop in gas fees, Ether price has declined by 53% since the Dencun upgrade.

During the upgrade in March 2024, ETH was trading above $4,070. One year later, as of March 13, 2025, ETH was valued at around $1,891, according to CoinGecko data.

In a statement sent to Cointelegraph, Dominik Harz, the co-founder of hybrid layer-2 Build on Bitcoin (BOB), said Ethereum has “underperformed” recently:

“Monday’s price drop erased all DeFi TVL gains since Trump’s election. Between Solana’s memecoin frenzy and Ethereum’s fractured few months, it’s clear the industry is searching for a new, more sustainable and secure frontier for DeFi.”

Related: More than 50% of validators signal to increase ETH gas limit

Upcoming Pectra upgrade sees hiccups

On March 5, Ethereum’s next major upgrade, Pectra, rolled out on its final testnet, Sepolia. However, the team started seeing error messages and empty blocks being mined.

Ethereum developer Marius van der Wijden confirmed that a fix was deployed, but an unknown user later triggered the same error, leading to further issues. The development team has since managed to stabilize the testnet and successfully process transactions.

Harz said that while these testnet issues are “disrupting the mainnet launch,” they are far from Ethereum’s biggest problems. The executive said that once Pectra goes live, it will double the available data space for layer-2s, reduce costs and increase execution capacity.

“While that’s a step in the right direction, the reality is that Ethereum is quickly losing its position as the go-to chain for builders, and Pectra isn’t the fix-all solution to its deeper issues,” Harz said.