Bitcoin is seeing a gradual return to buyer interest, but it is large-volume investors leading the way as others remain hesitant after weeks of downside.

Bitcoin whales are back buying BTC while “panic” is keeping smaller investors away, according to new research.

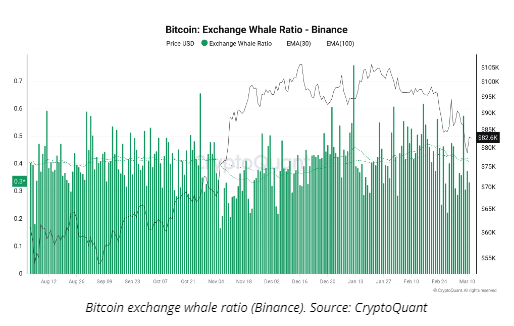

Data from onchain analytics platform CryptoQuant shows sell-side pressure from Binance whales cooling.

Bitcoin whales reset market approach

Bitcoin at $80,000 is proving attractive for large-volume investors, or at least a poor value selling proposition for those wishing to exit the market.

In a “Quicktake” blog post on March 12, CryptoQuant contributor Darkfost revealed that the proportion of the top 10 largest inflows to Binance attributed to whales has declined.

“Monitoring whale behavior has consistently provided valuable insights into potential market movements,” they summarized.

“Given that Binance handles the highest volumes, analyzing the Bitcoin exchange whale ratio on Binance provides a good insight into broader whale activity.”

The exchange’s whale ratio has, in fact, exhibited a broad downtrend since mid-January when BTC/USD hit its latest all-time highs.

“Currently, this ratio is declining, implying that Binance’s whales are reducing their selling pressure,” the post continued.

“Historically, an increasing ratio has been associated with short-term price corrections or consolidation phases, while a decreasing ratio has often preceded bullish trends. If this trend of diminishing selling pressure continues, it could help end the current correction and potentially signal a market rebound.”

As Cointelegraph reported, both whales and larger entities holding at least 10 BTC have begun to accumulate coins this month, albeit at modest rates.

Prospective BTC buyers “hesitant” at $80,000

Overall appetite for BTC exposure nonetheless remains suppressed.

Related: Bitcoin gets March 25 ‘blast-off date' as US dollar hits 4-month low

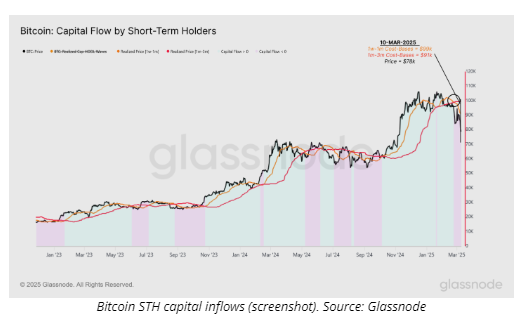

In the latest edition of its regular newsletter, “The Week Onchain,” analytics firm Glassnode pointed to lackluster demand at current prices.

It referenced capital flows by short-term holders (STHs) — speculative entities holding coins for up to six months. Within this cohort, buyers holding between one week and one month now have a lower cost basis than those holding for between one and three months.

“With Bitcoin prices dropping below $95k, this model also confirmed a transition into net capital outflows, as the 1w–1m cost basis fell below the 1m–3m cost basis,” the researchers explained.

“This reversal indicates that macro uncertainty has spooked demand, reducing new inflows and arguably increasing the probability of further sell pressure and a prolonged correction. This transition suggests that new buyers are now hesitant to absorb sell-side pressure, reinforcing the shift from post-ATH euphoria into a more cautious market environment.”