Bitcoin whales are among likely sources of BTC price support on the radar after a mass liquidation cascade.

Bitcoin dropped to multimonth lows on Feb. 25 as a fresh liquidity cascade sent its price action tumbling to near $86,000.

February BTC price losses near 13%

Data from Cointelegraph Markets Pro and TradingView showed Bitcoin losses mounting during the Asia and Europe trading session.

BTC/USD fell as low as $86,314 on Bitstamp, marking its deepest floor since Nov. 15, 2024. Crypto market sentiment, as measured via the Crypto Fear & Greed Index, returned to “extreme fear.”

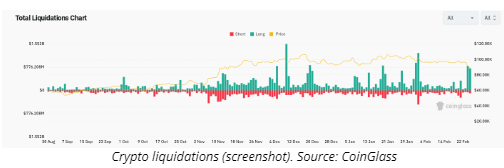

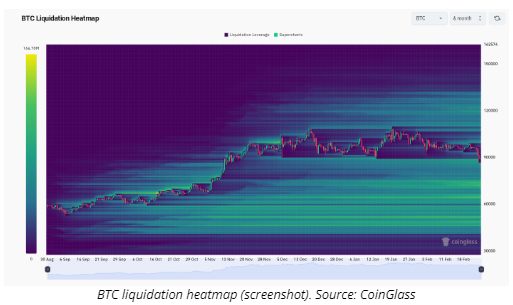

Twenty-four-hour crypto market liquidations passed $1.5 billion, per data from monitoring resource CoinGlass, with Bitcoin eating through long liquidations with ease.

CoinGlass showed only a band of buyer interest in the mid-$80,000 range standing in the way of further downside as traders scrambled to adjust.

Reacting, crypto investor and entrepreneur Alistair Milne noted that on daily timeframes, BTC/USD had triggered an “oversold” signal on the relative strength index (RSI) indicator, which fell below 30 on the day.

“Bitcoin touches oversold territory on the daily for the first time since August last year (when Bitcoin crashed to $49k),” he wrote in a post on X.

“Being oversold (or even close to) on the daily is one of the most reliable indicators of bottom/reversal territory. Only happens a handful of times per year.”

Some market participants were less optimistic, including on higher timeframes, with trader SuperBro warning that the fate of the bull market was at stake.

“This is about as far as we can go while keeping the near-term bull thesis intact,” he told X followers about the latest BTC price dip.

Bitcoin whale support in focus

Bitcoin has tested sub-$90,000 levels before as part of its multimonth trading range.

Related: $90K bull market support retest? 5 things to know in Bitcoin this week

Its last dip into the $80,000 range was in mid-January as part of a daily candle wick, which has remained unfilled since.

Then, BTC/USD reached $89,200 before reversing, and the surrounding area has since strengthened as support.

As Cointelegraph reported, “newer” Bitcoin whales — those active for up to six months — have their cost basis immediately below the $90,000 mark.

“The realized price of new whales = $89.2K, which is essentially the strongest support level for the current consolidation,” Axel Adler Jr., a contributor to onchain analytics platform CryptoQuant, reported earlier this month.

More recently, exchange order book liquidity trends have led market participants to eye $86,000 as a potential reversal zone.

(This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.)