Wintermute withdrew $40 million in SOL ahead of a $2-billion token unlock, raising concerns over selling pressure as market sentiment worsens.

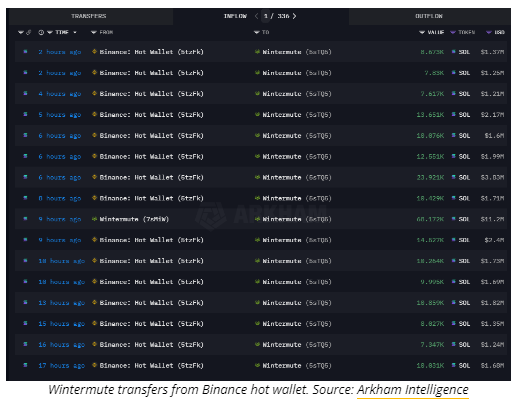

Wintermute withdrew nearly $40 million worth of Solana from Binance in the past 24 hours, over a week ahead of the largest Solana token unlock in the project’s history.

Crypto market maker Wintermute withdrew over $38.2 million worth of Solana from the Binance exchange in the 24 hours leading up to 9:02 am UTC on Feb. 24, Arkham Intelligence data shows.

The transfers occurred days ahead of Solana’s $2-billion token unlock, which is set to release over 11.2 million SOL tokens into circulation on March 1.

Solana’s price fell by over 7.5% in the past 24 hours to an over three-month low of $155, last seen at the beginning of November 2024, Cointelegraph Markets Pro data shows.

Some crypto industry watchers are concerned that the token unlock may introduce significant selling pressure for Solana since a significant portion of the locked supply was purchased at FTX auctions at a discount compared to today’s price.

Related: Solana sees 40% decline in user activity as memecoin rug pulls erode trust

Solana risks significant selling pressure from VCs

Solana’s upcoming token unlock may add significant selling pressure for the cryptocurrency.

Crypto analyst Artchick.eth noted that over the next three months, more than 15 million SOL — worth roughly $2.5 billion — will enter circulation. Many of these tokens were purchased at $64 per SOL in FTX’s auctions by firms such as Galaxy Digital, Pantera Capital and Figure:

“The majority of this SOL was purchased from FTX auctions at $64 by Galaxy, still a very healthy profit. […] By the time this SOL unlocks, another ~$1B of SOL will be produced via inflation and likely dumped as well.”

Similarly, crypto trader RunnerXBT mentioned that it was a “dangerous” period to buy Solana, highlighting that Galaxy Digital, Pantera and Figure stand to gain $3 billion, $1 billion and $150 million, respectively, in unrealized profits once their SOL unlocks.

Related: Bybit hackers may be behind Solana memecoin scams — ZachXBT

The inference is that most of these companies are likely to sell their allocations, as there is little incentive to hold SOL amid worsening market sentiment exaggerated by the recent Libra (LIBRA) memecoin scandal, a memecoin endorsed by Argentine President Javier Milei.

The project’s insiders allegedly siphoned over $107 million worth of liquidity in a rug pull, triggering a 94% price collapse within hours and wiping out $4 billion in investor capital.