The rapid development of cryptocurrency and financial technology innovation has made MicroStrategy (MSTR) a shining star in the industry due to its precise Bitcoin strategy and steadfast commitment. The economic model behind it not only highlights extraordinary strategic foresight but has earned widespread acclaim in the industry, creating several-fold wealth for investors in the short term. Now, in the emerging and opportunity-filled field of Real World Assets (RWA), the LANT RWA project, with its strategic deployment, is offering us an investment feast, leading and transforming the global landscape of physical asset tokenization, and attracting increasing attention and followership from DAO communities.

If MSTR established a pipeline for the value flow between Wall Street's traditional stock assets and the crypto market, thus reviving the stagnant traditional financial market, LANT RWA is building a bridge for the value flow between the trillion-dollar cultural relics and art market and the crypto market, injecting massive asset power into the crypto space. What are the unique features of the LANT RWA economic model? Through the study of its whitepaper, we will conduct an initial exploration, offering preliminary insights and looking forward to further exploration with professional analysts from investment banks.

1. LANT as a Pioneer in the RWA Field

With the rise of the concept of RWA (Real World Assets), assets in the physical world are gradually being converted into digital assets. This process not only greatly enhances the liquidity of physical assets but also injects energy into the crypto market, promoting efficient global asset trading and management.

As a pioneer in the RWA space, the LANT project has already raised an initial $1 billion in cultural relic assets, far surpassing the Hong Kong government's recommended RWA issuance of HKD 1 billion. It has attracted attention from many well-known DAO communities and investors globally. With its unique economic model innovation, LANT is becoming a benchmark project in the RWA space, leading the way in fair value management of assets, physical asset regulation, financial model innovation, and compliance management. If the LANT RWA project has a value cap, it is undoubtedly built upon the foundation of a $1 billion market value anchored to physical asset value, a consensus reached in the capital markets from Hong Kong to Singapore, through Dubai, and into the Americas. When judging returns, it is imaginable that the potential for growth is infinite, given that cultural relics, like the crypto market, are characterized by broadening consensus, leading to ever-higher prices.

2. LANT Project's Asset and Crypto Value Anchoring

The LANT project, initiated by the Hong Kong-based Lanting Blockchain Limited., aims to create a secure, transparent, and decentralized global digital asset platform for cultural relics and artworks—a world-class digital asset bank for cultural relics and artworks. The platform's initial assets are provided by the private collection of Taiwan’s Lanting Sister, with official asset confirmation from the corporate entity, setting it apart from purely cryptocurrency fund management approaches and enhancing trust with users.

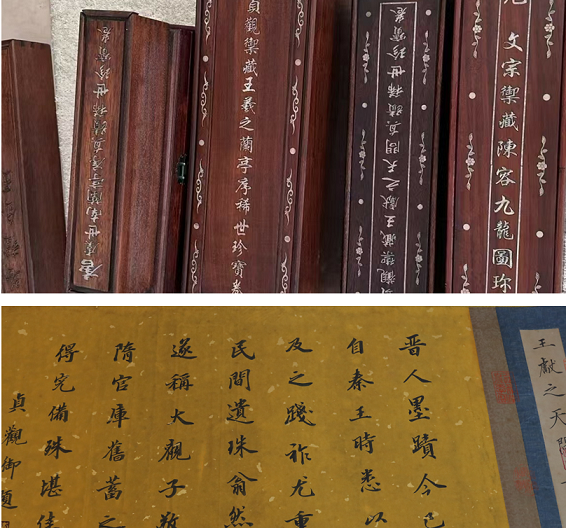

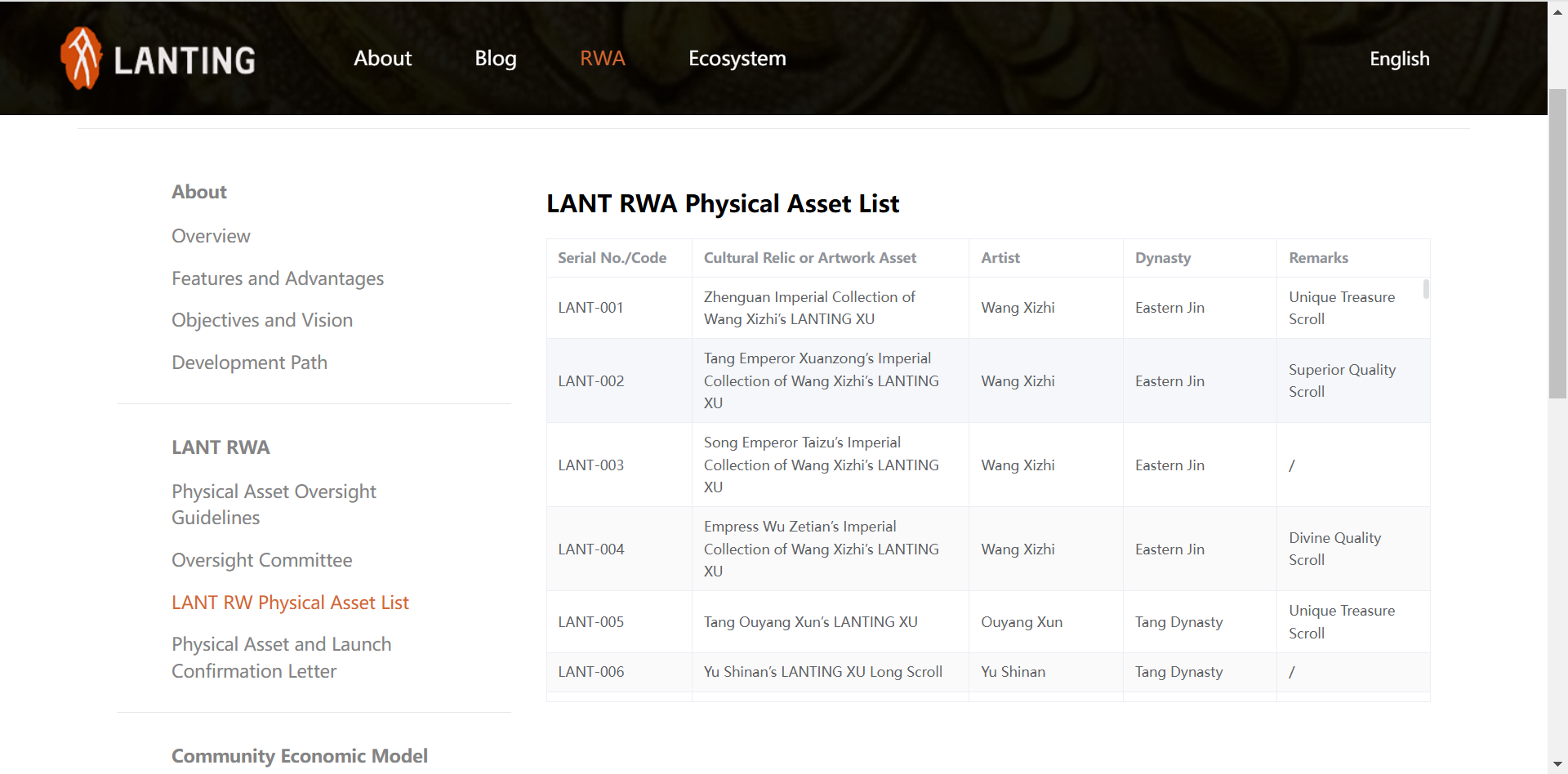

According to LANT's official website (lantcoin.com), the LANT project offers over $1 billion worth of precious cultural relics and artworks, such as the original manuscript of "Lanting XU" by Eastern Jin Dynasty calligrapher Wang Xizhi, spanning from the 4th century to the 16th century, many of which are royal collections. These assets will be digitized and minted into LANT tokens, providing new investment and profit opportunities for cultural relic and art asset holders as well as global investors. Expert insights from the international cultural relics community indicate that compared to the collections of the British Museum and the Taipei Palace Museum, any piece from LANT's assets, if auctioned, would likely exceed $100 million. With this in mind, the value of LANT's initial 490 cultural relics and artworks is far beyond $1 billion. Based on an average price of $2 million per relic, this creates significant potential for investor returns. Such high premium capabilities in physical assets represent bold ambition, large-scale vision, and the foundational force injected into the crypto market—value transfer and conversion are key.

3. An Unconventional Analysis of the LANT Economic Model

The economic model of the LANT project is crucial to its commercial value, with key elements being: 1:1 value anchoring, DAO, and incentive funds. These elements are central to bringing about a major revolution in physical assets and infusing faith into the crypto market. The LANT model integrates decentralized finance (DeFi) principles to create a win-win ecosystem for all participants. There are several focal points in the model that merit in-depth analysis:

a) Community Economic Model: By coordinating global mainstream blockchain networks with the Lanting mainchain network and through the joint contributions of participants, LANT ensures the continuous growth of value. LANT TOKEN, as the utility token for RWA, plays a key role in financial investment, staking rewards, transaction fees, and token appreciation, ensuring the steady development of the economic system.

b) Physical Asset Deflationary Pricing and Appreciation: By injecting deflationary mechanisms into physical assets, the LANT token issuance creates potential for value appreciation. The first batch of LANT RWA assets is valued at over $1.15 billion, but the overall project valuation is pegged at $1 billion, providing investors with a practical value release range of 15% to 500 times.

c) Dynamic Pricing Mechanism: Through a locking mechanism, the price of LANT will face less upward resistance and be dynamically adjusted according to the market. More user participation or increased asset tokenization will drive demand for LANT tokens, thereby raising the market price.

d) Physical Asset Valuation and Incentive Model: Every year, the LANT RWA Asset Regulatory Committee will evaluate the value of physical assets. If the fair market value of these assets increases by more than 20% compared to the previous year's evaluation, the LANT incentive fund will be used as a reward to motivate users to engage with the platform. As we know, the art market is a speculative one, where the price of cultural heritage items continually rises due to broad consensus on their value, injecting constant energy into the crypto market.

e) Asset Staking Model: Users are encouraged to lock LANT tokens in exchange for annual rewards. LANT will dynamically adjust the annual reward rate based on market conditions to improve user participation and platform stability. The "first mining" aspect of LANT is also noteworthy—staking mainstream cryptocurrencies to generate yield will attract more loyal users and off-chain trading pairs.

f) Ecosystem Contribution Incentive Model: Revenue generated from the lending of cultural relics, physical and digital derivatives, gaming, blind box mining, and other ecosystem projects will be proportionally distributed to community contributors, promoting ecosystem development and a sense of user belonging. According to the whitepaper, LANT is bridging the gap between physical asset derivatives and crypto users. Its Layer-2 ecosystem performance will unlock a $300 trillion derivative market opportunity in the global cultural relics and art market, with 90% of profits directed to participants in the ecosystem projects. This will inevitably attract countless DAO community organizations, fostering a flourishing ecosystem and early benefits. After all, as investors, who wouldn't want to experience the legendary returns of Black Wukong? An ecosystem, users, and growth—that’s the essence of a true RWA project.

4. Opportunities and Challenges of the LANT RWA Project

Objectively, with the rise of RWA as a recognized asset in the crypto world, the LANT project's innovative economic model and the continued expansion of LANT assets into physical industries and the internet, metaverse, and crypto markets, there is unprecedented development potential. However, we must also recognize the potential risks inherent in the RWA track, which shares similar risks with other crypto projects. Several points should be carefully considered:

a) For investors, high returns come with high risks. The ability to recognize the fair value and consensus of LANT's cultural relic assets will determine the price direction in the crypto market.

b) Whether LANT's innovative economic model can be successfully implemented depends on technical and market conditions.

c) Whether Hong Kong's regulatory environment is friendly to RWA.

d) Whether it is possible to isolate risks from non-friendly crypto market countries and regions.

e) The opportunity to access early allocation.

f) Whether the project has a DAO governance structure.

Looking back at the development of global crypto projects in recent years, two fundamental principles often determine a project's success: First, the distribution of tokens must be sufficiently decentralized until full circulation is achieved; second, there must be no single dominant beneficiary of the project. From reading the LANT whitepaper, it seems the project adheres to these governance principles and beliefs.