According to my recent visit in Taipei, the much-discussed LANT project in several DAO communities has officially confirmed its upcoming launch. LANT will bring a private collection of $1 billion worth of cultural relic assets into the Web 3.0 space, becoming the world’s first RWA (Real-World Asset) crypto project to inject physical assets. These assets are not only of significant historical value, but they also have substantial potential for appreciation. They come with their own fanbase and derivative cultural product ecosystems, making them worth the attention and pursuit of every investor.

As we all know, cultural relics and artworks are some of the most immeasurable and priceless assets on this planet. Countless artifacts have broken new records in auctions, selling for high prices and becoming unique assets in global wealth management portfolios. The market value of cultural derivatives is even more vast and full of potential. According to reports released by the Basel Art Fair and UBS Group, the global market for tradable cultural relic and artwork assets reaches $1.7 trillion, and the derivative market is expected to reach $300 trillion. Aside from a few countries that nationalize and restrict the trade of cultural assets, most cultural relics and artworks are freely traded via national museums or private collections, allowing for the circulation and transfer of value. Today, the traditional auction scene where a hammer falls to close a deal will be fundamentally altered. The emotional toll of missing out on an auction will eventually be compensated by RWA crypto investments, allowing everyone in the world to have equal rights and opportunities to invest in cultural relics and artworks.

The LANT project is causing a massive stir in the market by innovating with blockchain, cryptocurrency, and other core Web 3.0 technologies and financial models. It has already become one of the hottest buzzwords in the market. At last week’s Global RWA Industry Alliance Preparatory Meeting in Hong Kong, discussions among leaders in the asset and crypto space about the tokenization of cultural asset values further validated this trend, indicating the clear emergence of a new market window. This could potentially change the challenges that early-stage projects have faced in recent years—such as resource scarcity and the reliance on secondary markets for crypto investments.

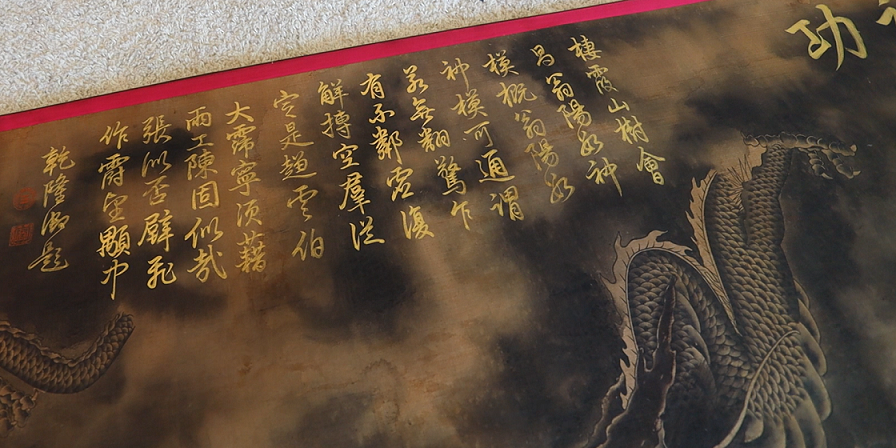

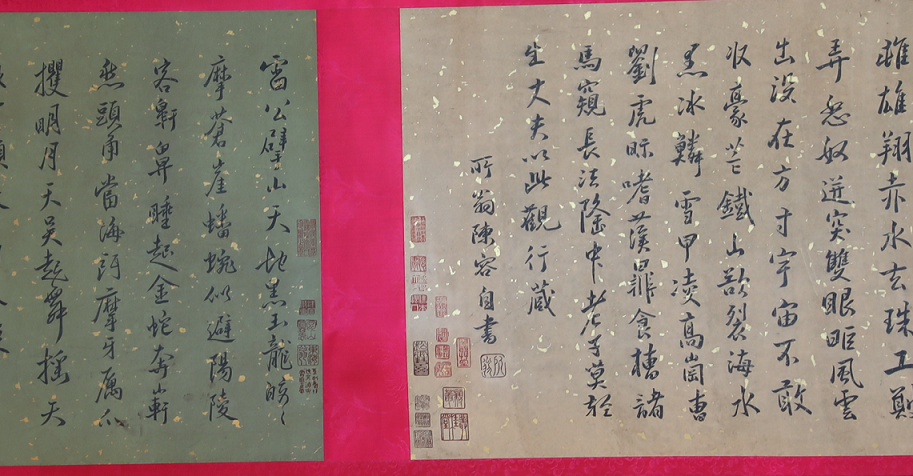

It is reported that the first phase of the LANT project will involve bringing several rare cultural relics into the Web 3.0 space, creating a global digital asset platform for cultural relics and artworks. One of the key items is the Lanting XU from the 4th century, which has passed through several imperial collections across multiple dynasties. After being hidden away for centuries, this artifact will now surface, sparking potential disputes within the global art community and stimulating endless possibilities in the crypto market.

(If Wang Xizhi’s Lanting XU wasn’t allowed for auction, but Chen Rong’s Nine Dragons was successfully photographed, how much would these words be worth?)

As governments around the world begin to build strategic reserves of crypto assets, where will the crypto market head? I propose a question that must be addressed: In the global crypto market, will it continue to be driven by speculative battles fueled by concepts and big promises, or will the combination of RWA physical asset values and crypto returns lead the market to a more substantial value-driven approach?

In any case, LANT has established a "blockchain bridge" that opens two Pandora’s boxes—the real-world value of cultural relics and the value of the crypto market. Watching for early investment opportunities in LANT and securing a position in the project’s initial mining phase is certainly something worthwhile. Personally, I’m excited by the thought of being a "quick gun" to earn money while also securing the potential returns from cultural asset investments. Just think of the Black Wukong and the over 8 million artifacts in the British Museum—who wouldn’t be tempted?