With the rapid development of the global shift from traditional financial systems to new financial orders, the LANT RWA project offers immense potential for both the cultural relics and art industry and crypto investors, inevitably attracting global attention. From the successful injection of $1 billion in cultural relics and artworks in the first phase to the gradual implementation of Layer-1 platform services, LANT will provide a foundational platform for the tokenization of the $1.7 trillion traditional cultural relics and artworks market.

According to the LANT whitepaper, the project will build a robust Layer-1 infrastructure, complete the mainnet construction, and establish an innovative financial ecosystem for cultural relics and artworks, creating a win-win situation for all participants. It integrates Decentralized Finance (DeFi) principles, enabling revenue generation, investment returns, and community rewards, while maintaining ecological economic balance.

1. A Continuously Appreciating Niche Market, Where the Closed Loop is Sky’s the Limit

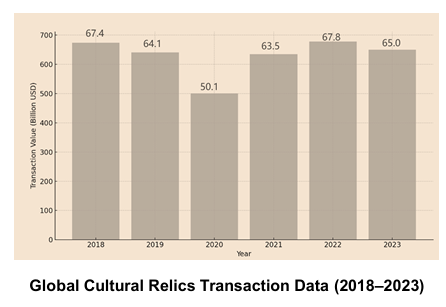

Traditionally, we assume that markets experience ups and downs, reaching an overall balance. However, when we focus on the cultural relics and artworks market, we find that it is an almost uniformly appreciating market. According to the Basel Art Fair and UBS Global Art Market Report, despite the impacts of the pandemic, the traditional cultural relics and artworks market has maintained a transaction scale of $65 billion annually. Historical auction data shows that cultural relics and artworks are characterized by continuous appreciation.

We all agree that each piece of cultural relic is a rare human cultural heritage, an irreplaceable, unique asset, and auction prices often reach new highs. In the worst-case scenario, transactions may simply pause. Thus, within the global RWA asset class, the cultural relics and artworks market is one of the most unique, and its upper value limit is as high as the sky.

2. The Investment Blue Ocean of the Crypto Market

In the early stages of the crypto market, investors often overlooked the intrinsic value of crypto assets and relied purely on market speculation to build an inflated vision for the future of crypto. However, when MSTR bridged the gap between traditional stock market assets and the crypto market, it unleashed remarkable financial market appeal. High-level investors have gradually emerged, shifting focus from short-term operations and models to understanding the real social value and influence of projects, making them suitable for long-term investment and return. This is similar to the strategic reserves of BTC by various countries. Likewise, with global financial institutions now focusing on RWA tokenization, LANT, through its Layer-1 infrastructure and Layer-2 ecosystem, has established a secure channel that could lead the assets of over 55,000 museums worldwide (including private collections) to merge and integrate with the massive financial ecosystem. We can even imagine a scenario where 380,000 items from the Louvre Museum and 8 million pieces from the British Museum are opened to global investors via the crypto market—this will undoubtedly be a cultural and financial feast.

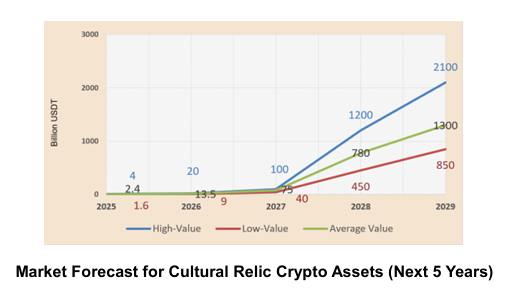

According to predictions from crypto research institutions, with the establishment of RWA platforms, the injection of physical assets, and the provision of crypto-asset services, the annual transaction scale of the cultural relics and artworks market is expected to reach an average of $1.3 trillion in digital USD within the next five years. The number of participants will grow from over 20 million high-net-worth individuals with high asset holdings to over 500 million crypto asset investors. We believe LANT will make significant contributions in the tokenization, financialization, and liquidity enhancement of cultural relics and artworks, driving huge momentum for the new global financial order based on cryptocurrency to replace traditional financial systems.

3. Multiple Revenue Models to Safeguard Returns

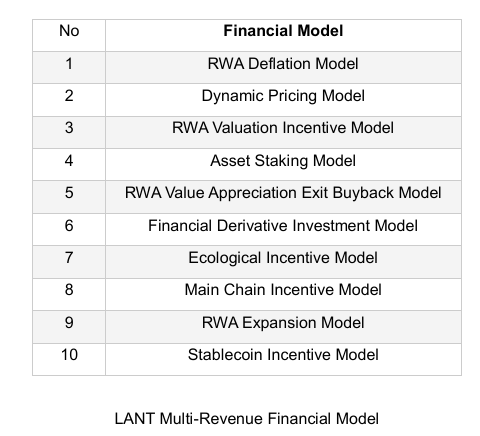

In the crypto market, financial models, or more simply put, unique market mechanisms, provide investors with diverse and colorful investment opportunities. High-level financial models often require sophisticated mathematical algorithms and economic theories. Anyone who has read Ludwig von Bertalanffy’s General System Theory or Chinese scientist Qian Xuesen’s System Theory understands that systematic thinking and recognition are crucial for judging and controlling the essence and development direction of physical assets.

LANT already has a multi-benefit financial model foundation. From the early-access LANT whitepaper I reviewed, the ten financial models collaborate with both top-tier designs and simple, practical, easy-to-implement features, showing the work of top economists and financial practitioners. These models encompass physical asset income incentives, crypto-asset lending, financial derivatives, and more, while DAO governance ensures decentralized decision-making and includes specialized incentive pools. These include deflationary incentives for physical assets, RWA asset appreciation incentives, RWA asset exit incentives (buyback and burn), asset expansion incentives, mainnet coin incentives, GameFi and other derivative project incentives, and stablecoin incentives.

In summary, the multiple revenue models will safeguard LANT users’ continuous returns, creating a new wealth legend in the generally appreciating cultural relics and artworks market.

4. The More Decisive the DAO Decision-Making, the More Successful It Becomes

From past experiences, we can definitively say that markets controlled by manipulators are short-lived and lack development momentum. Those glamorous markets controlled by big players are often backed by sharp sickles, and ultimately, the market will phase them out. Truly successful crypto projects tend to have sufficiently decentralized token distributions and no predetermined largest beneficiaries. From LANT’s whitepaper, we understand that this philosophy is deeply integrated into the project’s operations.

With physical assets as anchors, LANT differentiates itself from ordinary crypto projects. It opens cultural relics and artworks to global users, and the DAO governance team, DAO community, and third-party asset custody mechanisms all adhere to one principle: decentralized technology platforms and architectures ensure that LANT’s development is sustained by community-based decision-making. Success for users equals success for the project, thereby increasing its market competitiveness. Additionally, the LANT incentive fund pool, combined with DAO community regulation, injects financial support for the long-term development of the DAO organization and the market.

5. Regulatory Support

LANT stands out from traditional risk-averse foundation governance models by employing an entity-based governance structure, initiated by compliant entities, and enhancing legal and regulatory compliance. On one hand, it ensures third-party oversight and valuation of physical assets, and on the other hand, it complies with regional jurisdictional requirements, filing and regulating according to RWA crypto-asset management rules in Hong Kong and other relevant regions. Through an experienced international legal team, LANT actively adheres to existing regulations regarding asset tokenization, digital currencies, and Decentralized Autonomous Organizations (DAO). Strengthening regulatory compliance ensures the long-term participation of project users.

In conclusion, in the RWA space, LANT will lead the development of trillion-dollar cultural relic and art markets as a Layer-1 infrastructure pioneer. It will attract investor attention and, through continued development, create substantial value for investors and cultural relics/art lovers alike.