US crypto stocks surged on Tuesday amid a shaky Donald Trump-brokered ceasefire agreement between Iran and Israel.

US crypto stocks surged alongside the broader market on Tuesday after a shaky ceasefire between Iran and Israel brokered by US President Donald Trump largely held.

Trump declared the ceasefire on social media on Monday, claiming it would “go on forever,” but both nations reportedly launched missile strikes shortly after the ceasefire went into effect, with Trump telling reporters on Tuesday that he thinks both countries violated the pact.

Coinbase tops S&P 500 gainers

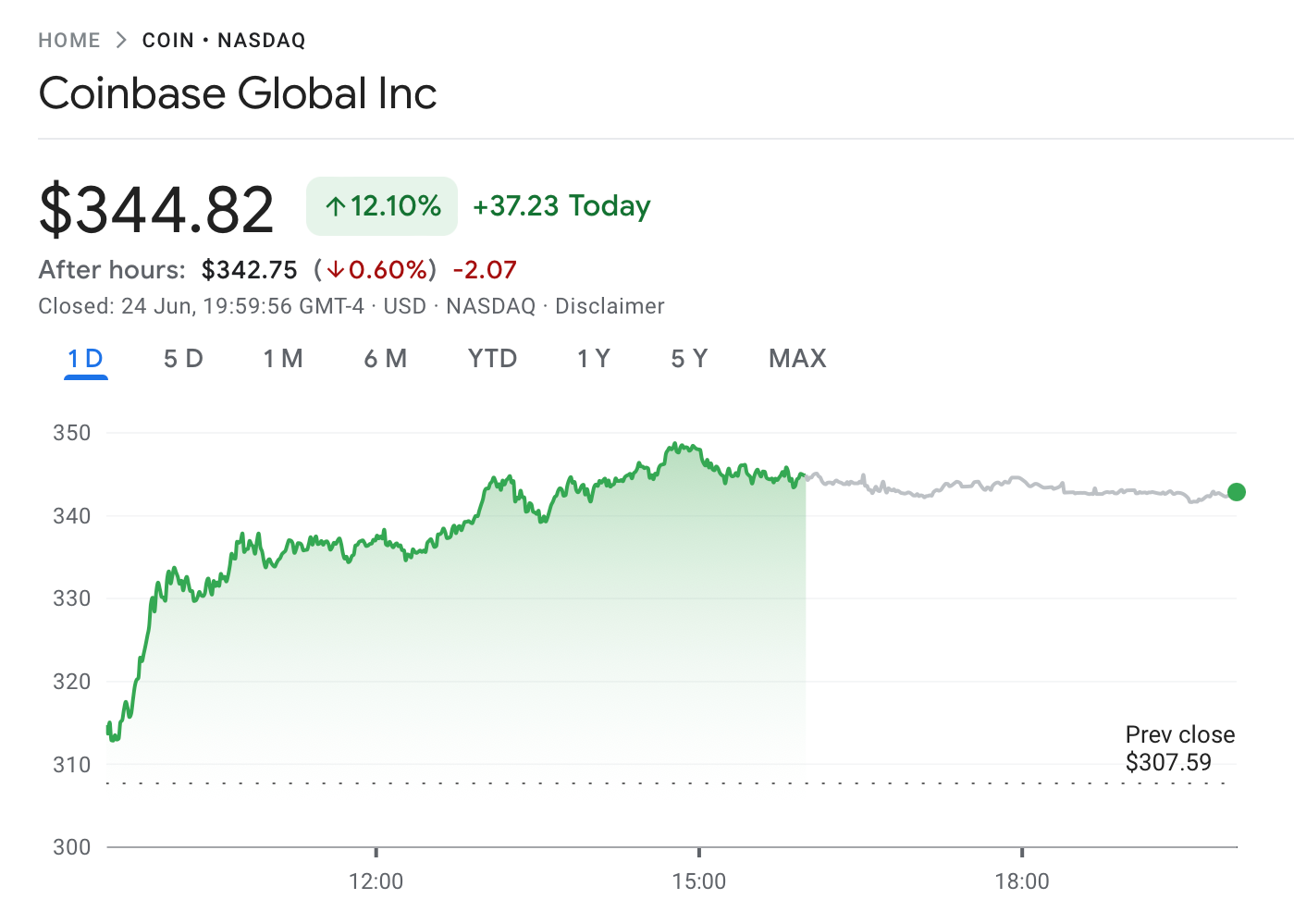

The ceasefire saw crypto stocks surge on Tuesday, with crypto exchange Coinbase Global Inc. (COIN) the best-performing S&P 500 stock for the day.

Coinbase closed the trading day up 12.10%. Meanwhile, crypto mining firm Riot Platforms spiked 8.09%, Marathon Digital rose 4.94%, and Michael Saylor’s Strategy (MSTR) gained 2.68%, according to Google Finance data.

Advertisement

Start Your Crypto Journey with Coinbase! Join millions worldwide who trust Coinbase to invest, spend, save, and earn crypto securely. Buy Bitcoin, Ethereum, and more with ease!

Coinbase was the best-performing S&P 500 stock on Tuesday. Source: Google Finance

The broader market also posted gains, with the S&P 500 closing up 1.11% on the day.

Robinhood Markets, Inc. (HOOD) climbed 7.41%, coinciding with the launch of its new 1% crypto deposit match promotion, which began Tuesday and runs through July 7.

Crypto market holds steady

Not all crypto stocks shared the rally. Stablecoin issuer Circle Internet Group (CRCL) slid 15.49% during Tuesday’s trading, but the newly listed company is still up nearly 620% since its debut at $31 on June 6.

Related: Bitcoin makes up one-third of investor crypto portfolios in 2025

Meanwhile, the crypto market has slowly resumed its uptrend, with Bitcoin

up 1.20% over the past 24 hours, trading at $106,487 at the time of publication. Ether

spiked 1.99%, and XRP

had a 1.92% gain, according to CoinMarketCap data.

The increasing interest in crypto stocks has other firms looking to go public, too. On June 23, it was reported that major global cryptocurrency exchange OKX is considering a public listing in the US following its relaunch in the country.