The CEO of Circle, which recently debuted on the New York Stock Exchange, predicts it won’t be long before stablecoins reach the level of developer attraction that the iPhone achieved.

While stablecoins have yet to attract developers at the same scale as Apple’s iPhone, stablecoin issuer Circle CEO Jeremy Allaire suggests that breakthrough moment isn’t far off.

“We are not quite yet at the iPhone moment when developers everywhere realize the power and opportunity of programmable digital dollars on the internet in the same way they saw the unlock of programmable mobile devices. Soon,” Allaire said in a post on Saturday.

“The highest utility form of money ever created,” he added.

Retail giants are eyeing stablecoins

Allaire’s comments came in response to a16z Crypto partner Sam Broner, who said in a post on the same day that “stablecoins are better because they encourage competition.”

“Now anyone can program money - the fixed and marginal costs of building a fintech are lower. More competition = better prices, better experiences, more access,” Broner added.

Source: Sam Broner

Advertisement

Start Your Crypto Journey with Coinbase! Join millions worldwide who trust Coinbase to invest, spend, save, and earn crypto securely. Buy Bitcoin, Ethereum, and more with ease!

It comes just a day after reports emerged that retail giants Walmart and Amazon are considering launching their own US dollar-backed stablecoins for customers.

Meanwhile, global e-commerce giant Shopify recently confirmed plans to integrate Circle’s USDC

stablecoin for payments by the end of 2025.

A16z Crypto data scientist Daren Matsuoka forecasts that stablecoins may be the answer to major adoption into crypto. “Stablecoins now present what I believe is the first credible opportunity to onboard a billion people into crypto,” Matsuoka said in a June 6 X post.

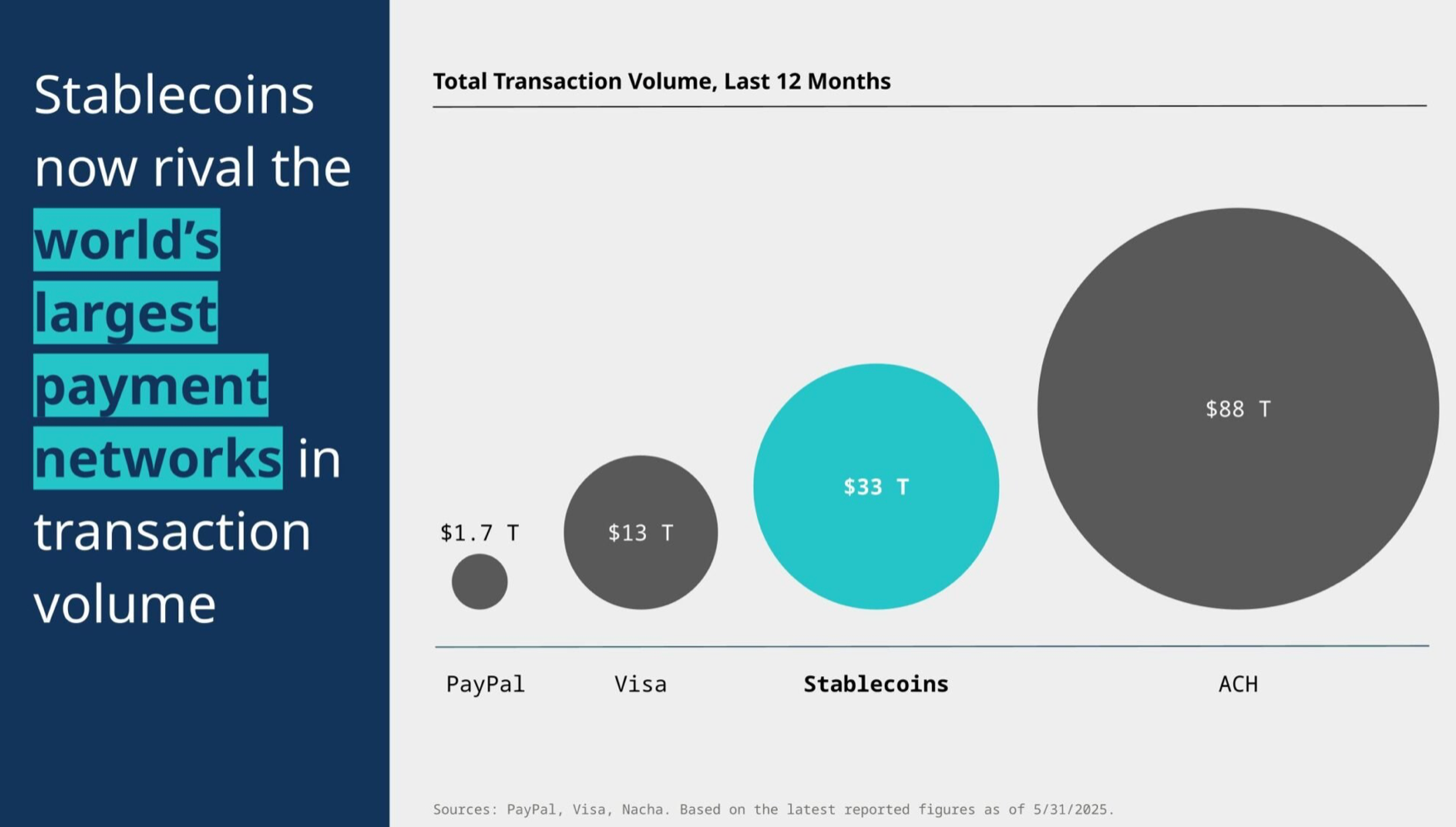

Stablecoin transaction volume close to 20X the volume of PayPal

Matsuoka pointed to the $33 trillion transaction volume that stablecoins have recorded over the past 12 months.

Stablecoins posted 19.4X more transaction volume over the past 12 months than PayPal. Source: Daren Matsuoka

“To put that into perspective, that’s close to 20 times the volume of PayPal, close to 3 times the volume of Visa, and quickly approaching the volume of ACH,” he said.

Related: USDC stablecoin launches on XRP Ledger

It comes after Circle’s recent debut on the New York Stock Exchange (NYSE). On June 5, the stablecoin issuer made a strong entry into the public market, with its shares climbing 167% in its first trading session.

However, Circle’s largest rival, Tether, the firm behind USDT

, expressed no interest in following the same path. Just days after Circle’s listing, on June 8, Tether CEO Paolo Ardoino said the stablecoin issuer has no intention of going public.