While the index remains in the “Greed” zone if history repeats following last year’s Israel-Iran tensions, it may decline into “Fear” in the coming weeks.

The Crypto Fear & Greed Index, which tracks overall crypto market sentiment, has remained in the “greed” zone despite rising geopolitical tensions after Israel launched a series of airstrikes on Iran.

The Index posted a score of 60 in its Sunday update, maintaining its position in the greed territory despite Bitcoin

falling 2.8% to $103,000 on Friday. This followed explosions reportedly heard in Tehran at 22:50 UTC on Thursday, which Israel claimed responsibility for. Iran reportedly retaliated with “dozens of ballistic missiles” on Friday night.

On Thursday, the Index was holding a Greed score of 71.

Bitcoin was nearing all-time highs

Bitcoin’s price decline came as it was edging closer to retesting its May 22 all-time high of $111,970. At the time of publication, Bitcoin is trading at $105,670, according to CoinMarketCap.

Bitcoin is up 0.07% over the past seven days. Source: CoinMarketCap

Ether

, meanwhile, dropped 10.79% over the same period to a low of $2,454 before recovering to $2,534 at the time of publication.

Advertisement

Start Your Crypto Journey with Coinbase! Join millions worldwide who trust Coinbase to invest, spend, save, and earn crypto securely. Buy Bitcoin, Ethereum, and more with ease!

Crypto market participants pointed out Bitcoin’s relative strength given the circumstances. Crypto analyst Za said in a Saturday X post, “Bitcoin does not seem concerned about the Israel and Iran conflict (yet).”

“There is no better indicator than Bitcoin, which makes this notable, in my opinion,” Za said.

Crypto entrepreneur Anthony Pompliano said in a post on the same day, “Bitcoin is relentless.”

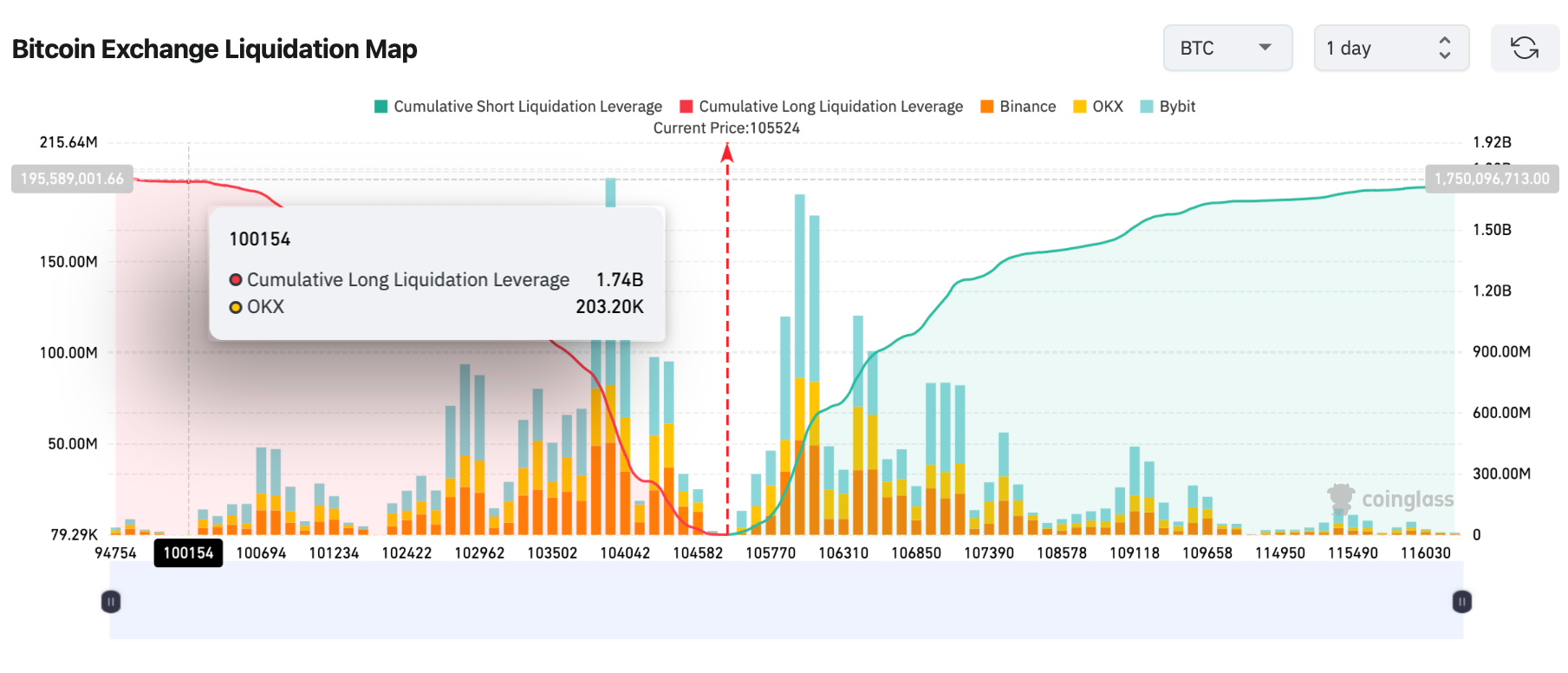

Traders appear to be holding confidence that it will remain above the psychological $100,000 price level, which it reclaimed on May 8 for the first time in three months. A drop below this price level could put over $1.74 billion in long positions at risk of liquidation, according to data from CoinGlass.

Over $1.74 billion in long positions are at risk if Bitcoin falls below $100,000. Source: CoinGlass

Meanwhile, spot Bitcoin exchange-traded funds (ETF) posted a straight week of inflows for the trading week ending Friday, accumulating $1.37 billion in inflows over the five days, according to Farside data.

However, spot Ether ETFs ended its 19-day inflow streak on Friday, with net outflows of $2.1 million.

Bitcoin falls less than after Iran attack in April 2024

Bitcoin’s price decline following the airstrike on Friday was less severe than in April 2024, when Iran launched an unprecedented direct attack on Israel.

Related: Bitcoin bulls are roaring back as BTC flirts with $112K

The strike, which was a retaliatory measure against Israeli bombings of the Iranian embassy in Damascus, sent the price of BTC plummeting 8.4% on April 13, 2024.

Although the index registered a “Greed” score of 72 on the same day, it had dropped to a “Fear” score of 43 by May 2, 2024.