Bitcoin short-term hodlers increasing their buying during price upswings, along with long-term holders continuing to accumulate regardless, sets a "bullish tone" for the year, according to a crypto analyst.

Bitcoin hodlers continuing to accumulate during price declines, along with short-term holders buying more during price surges driven by FOMO (fear of missing out), sets a “bullish tone” for 2025, according to a crypto analyst.

Long-term Bitcoin hodlers (LTH) — those who have held their Bitcoin for more than 155 days — dominance “remains high, signaling strong long-term conviction,” CryptoQuant contributor IT Tech said in a Jan. 24 analyst note. He said:

“They continue to accumulate during price declines and strategically take profits during upward trends.”

Short-term holder behavior is setting a ‘bullish tone’ for 2025

Meanwhile, IT Tech said that Bitcoin short-term holders — those who have held their Bitcoin for less than 155 days — seem more confident about buying into the market’s upside momentum, making him more optimistic about Bitcoin’s price over the next 12 months.

He said that short-term holders jumping in most when Bitcoin’s price is on the rise signals they’re “FOMO-driven entries.”

“Short-term holders acting on speculation, sets a bullish tone for 2025,” he said.

Throughout January, Bitcoin has hovered around the psychological $100,000 price level, dipping below it a few times while briefly reaching a new all-time high above $109,000 on Jan. 20, just ahead of Donald Trump’s inauguration as US president.

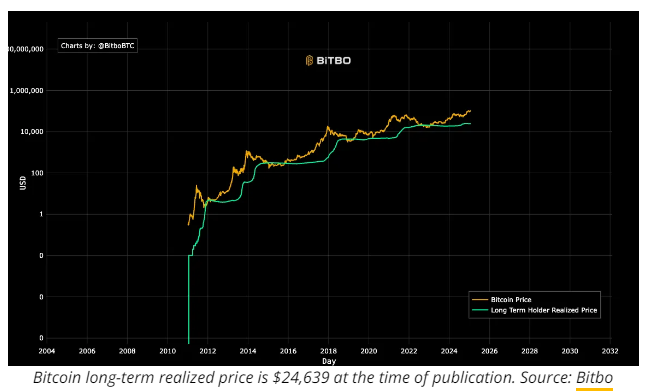

At the time of publication, the average long-term holder's cost is $24,639 per Bitcoin, which represents the average hodler is in profit of more than four times that amount, as per Bitbo data.

Bitcoin’s current price is $104,390, as per CoinMarketCap data.

The short-term realized price is $90,541. Data from Checkonchain, a Bitcoin onchain analysis program, indicated that 80% of short-term holders were back in the profit bracket after BTC’s recovery above $100,000. Earlier this month, the STH supply in loss dropped to 65% before Bitcoin rebounded.

LTH profit-taking creates accumulation opportunities

Meanwhile, IT Tech explained that occasional sell-offs by long-term holders shouldn’t be a cause for concern, as they can “create healthy pullbacks, offering opportunities for new accumulation,” he said.

Related: Bitcoin bull market at risk? 7 indicators warn of BTC price ‘cycle top’

According to a separate Jan. 24 analysis by CryptoQuant contributor “Crazzyblockk,” long-term holders are “largely avoiding significant selling, reinforcing a strong HODLing sentiment despite current market fluctuations.”

The analyst said that recent on-chain data revealed that only 18% of Bitcoin deposits into crypto exchange Binance come from long-term holders.