ChronoForge’s shutdown highlights mounting financial strain across Web3 gaming as shrinking budgets and dismal market sentiment take their toll.

ChronoForge, a Web3 game studio developing a multiplayer action RPG centered on onchain asset ownership, is shutting down after months of operating with a drastically reduced team, a closure that underscores the severe financial pressures facing the Web3 gaming sector during the current market downturn.

On Wednesday, the studio announced it will cease all services by Dec. 30, citing “many headwinds,” including a funding shortfall that forced the founders to finance development out of pocket since July and reduce staff by 80%.

In a statement posted to social media, the team said it had continued operating under intense financial strain, pushing out patches and new features “despite no marketing budget, below sustainment revenue, loss of codevelopers and terrible Web3 gaming sentiment.”

Source: ChronoForge

Abhishek Pawa, founder of the cryptocurrency consulting company AP Collective, said the closure “reflects how difficult the Web3 gaming market has been this cycle.”

ChronoForge was developed by Minted Loot Studios. Its affiliated entity, Rift Foundation, oversees the game’s token and ecosystem. The foundation raised more than $3 million through the sale of the RIFT token to support development.

The project became active in 2022, when it launched its first NFT collection and began early community-building efforts.

Related: VC Roundup: Big money, few deals as crypto venture funding dries up

GameFi’s broader struggle, and a few bright spots

Web3 gaming, often referred to as GameFi, has faced weak funding and declining user interest through much of 2025.

By late last year, 93% of Web3 game projects were considered defunct, according to a report by ChainPlay, a blockchain gaming platform. At the time, GameFi token prices had dropped 95% from their all-time high.

The trend marked a sharp reversal from the previous crypto bull market, which peaked in 2022 and fueled a surge in demand for GameFi projects.

Venture capital interest in the sector has also waned, given the dismal returns. More than half of the VCs that invested in GameFi as of late 2024 had lost money, according to ChainPlay.

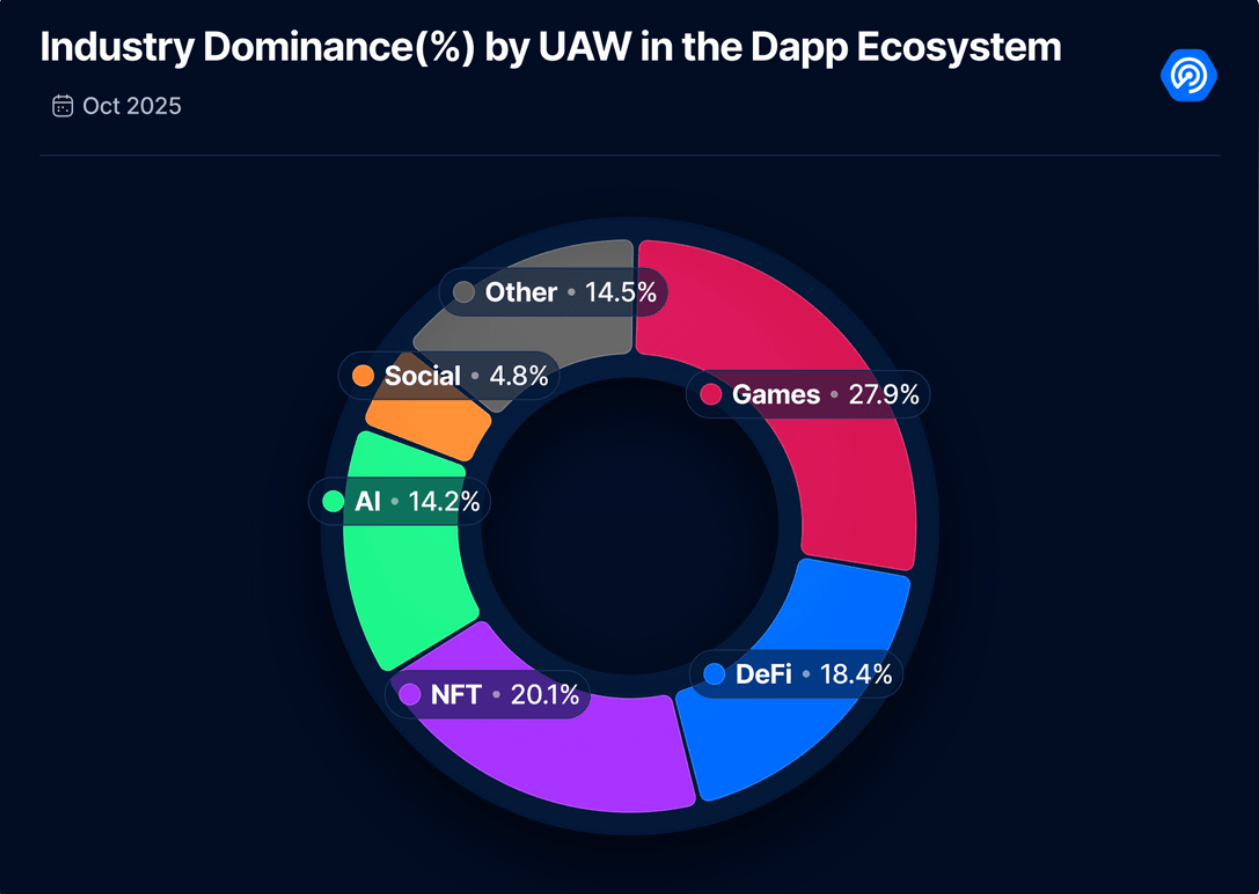

Still, there have been some bright spots. Data from DappRadar shows that GameFi and decentralized finance were the most active sectors in Web3 in October, with gaming accounting for nearly 28% of all decentralized application activity during the month.

Within Web3, gaming represented the highest number of unique active wallets in October. Source: DappRadar