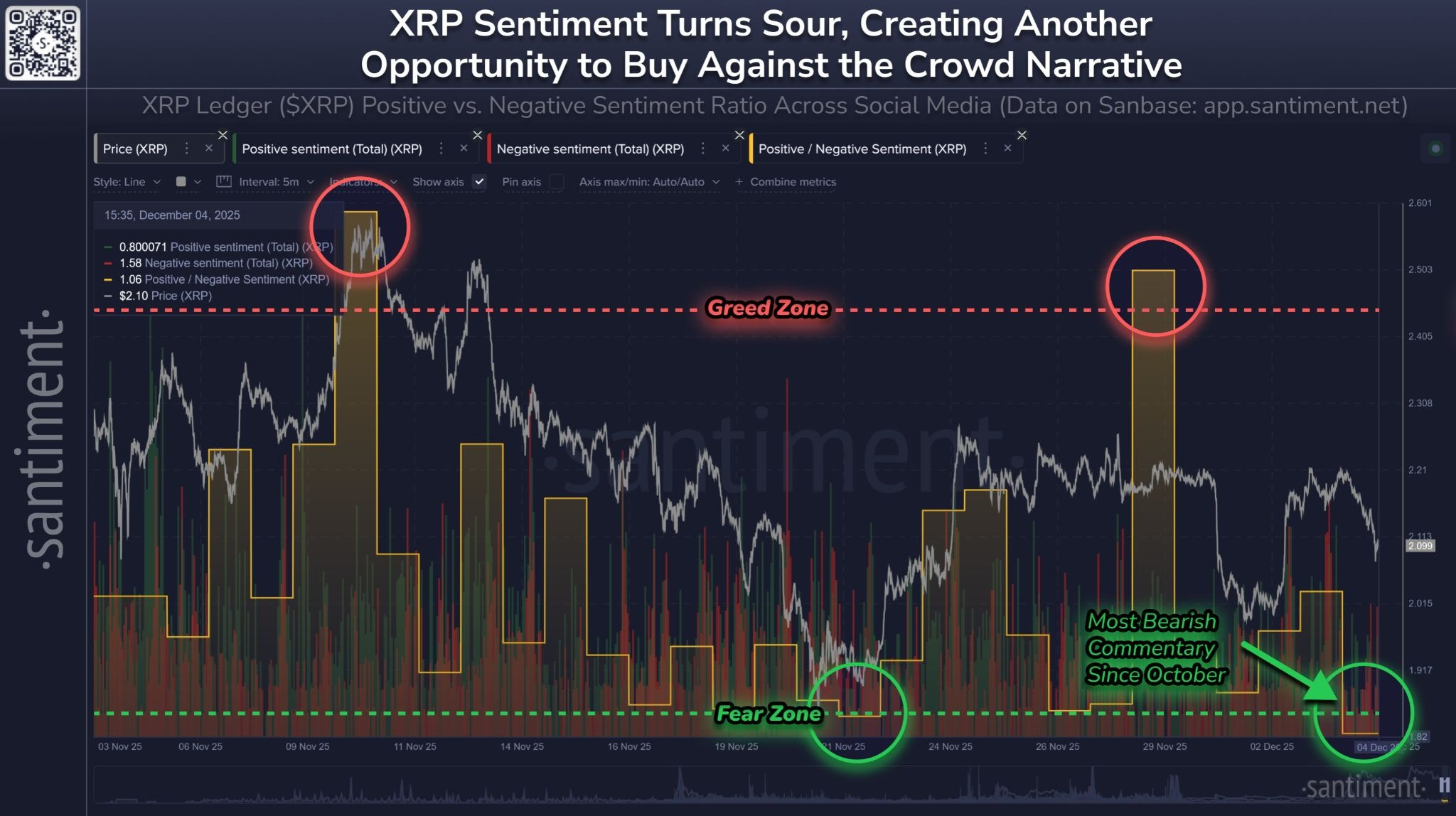

Santiment says social sentiment toward XRP has hit its lowest levels since October, entering the fear zone, but suggested that has preceded a rally in the past.

Social sentiment toward XRP has tanked into the “fear zone,” but the intelligence platform Santiment says a similar drop has led the token rallying.

Santiment said on Thursday that its social data is showing that XRP

is seeing “the most fear, uncertainty, and doubt (FUD) since October.”

“The last time we saw near this level of fear from the crowd was November 21, and XRP’s price immediately rallied 22% over the next three days,” it added.

“As of now, an opportunity appears to be emerging just like two weeks ago.”

XRP has dropped 4.6% over the past 24 hours to below $2.10, making it the worst performer out of the top 10 cryptocurrencies by market value. The token is currently 42% down from its July 2025 all-time high.

XRP social sentiment has dropped over the past two months, which Santiment said has created another buying opportunity. Source: Santiment

Sour social sentiment is not bearish

Crypto analysts agreed with Satiment that XRP’s drop is not necessarily bearish.

“XRP is looking less like a ripple and more like a puddle,” Justin d’Anethan, head of research at private markets advisory firm Arctic Digital, told Cointelegraph.

Traders see prices stuck in a low-conviction and close to a capitulation zone, at the $2 range, he said.

“This isn’t all bearish, though, as those often mark a bottom that can then capitalize on legal wins, regulatory clarity, a US-first approach, and a long-standing cross-border payment value.”

Related: XRP faces ‘now or never’ moment as traders eye rally to $2.50

LVRG Research director Nick Ruck said that “despite the bear market, XRP is holding firmly above its key $2 level as growing bullish momentum is fueled by sustained institutional inflows exceeding $750 million into spot ETFs this month alone.”

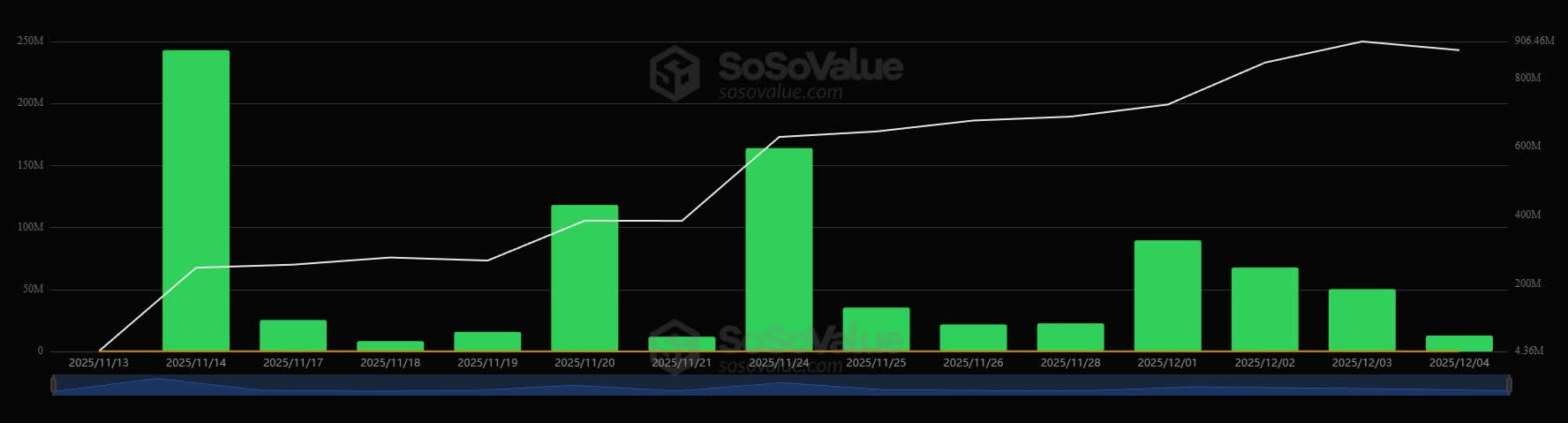

Spot XRP ETF flows dwindle

Net inflows to spot XRP exchange-traded funds slowed considerably this week, despite the positive start to trading. Inflows on Thursday were $12.8 million, the lowest since Nov. 21, according to SoSoValue.

Flows to XRP ETFs have slowed this week, but remain positive. Source: SoSoValue

However, the products have maintained positive flows since their launch in mid-November and have a total of $881 million in net assets across the five funds.