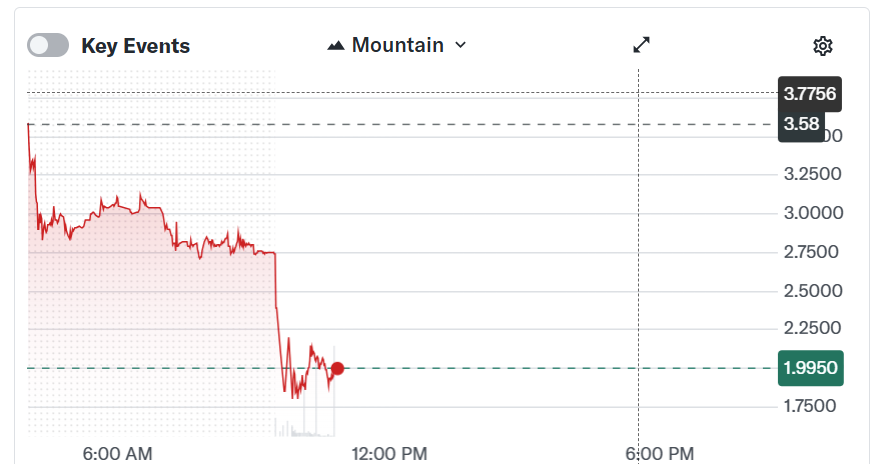

ABTC shares plunged by more than 50% in early trading as the broader crypto market downturn triggered a sharp repricing of mining and treasury stocks.

Shares of American Bitcoin Corp (ABTC), the Bitcoin-mining and treasury company headed by Eric Trump, plunged on Tuesday as difficult market conditions continued to pressure crypto-linked equities.

ABTC, which debuted on the Nasdaq in early September following a reverse merger with Gryphon Digital Mining, lost more than half its value in early trading. The stock reached an intraday low of $1.75, representing a 51% decline on the day, according to data from Yahoo Finance.

ABTC stock faced a steep decline on Tuesday. Source: Yahoo Finance

The shares are now down roughly 78% from their post-listing high of $9.31 on Sept. 9, underscoring the broad unwinding across the digital-asset sector and its spillover into related equities.

While no single catalyst appeared to drive Tuesday’s steep sell-off, crypto-linked stocks have faced renewed volatility in recent weeks amid a broad retreat in digital assets and profit-taking across technology shares.

American Bitcoin’s business is closely tied to the price of Bitcoin

, which has experienced one of its sharpest pullbacks in history since mid-October, falling from a peak near $126,000 to a November low of below $80,000.

Related: Scaramucci family invested over $100M in Trump’s Bitcoin mining firm: Report

The repricing of crypto-linked equities

The crypto market downturn has triggered a widespread repricing of crypto-exposed equities, particularly among miners and companies that hold large Bitcoin treasuries.

That reassessment has unfolded despite American Bitcoin Corp reporting a swing to profitability in the third quarter, when net income reached $3.47 million and revenue climbed to $64.2 million.

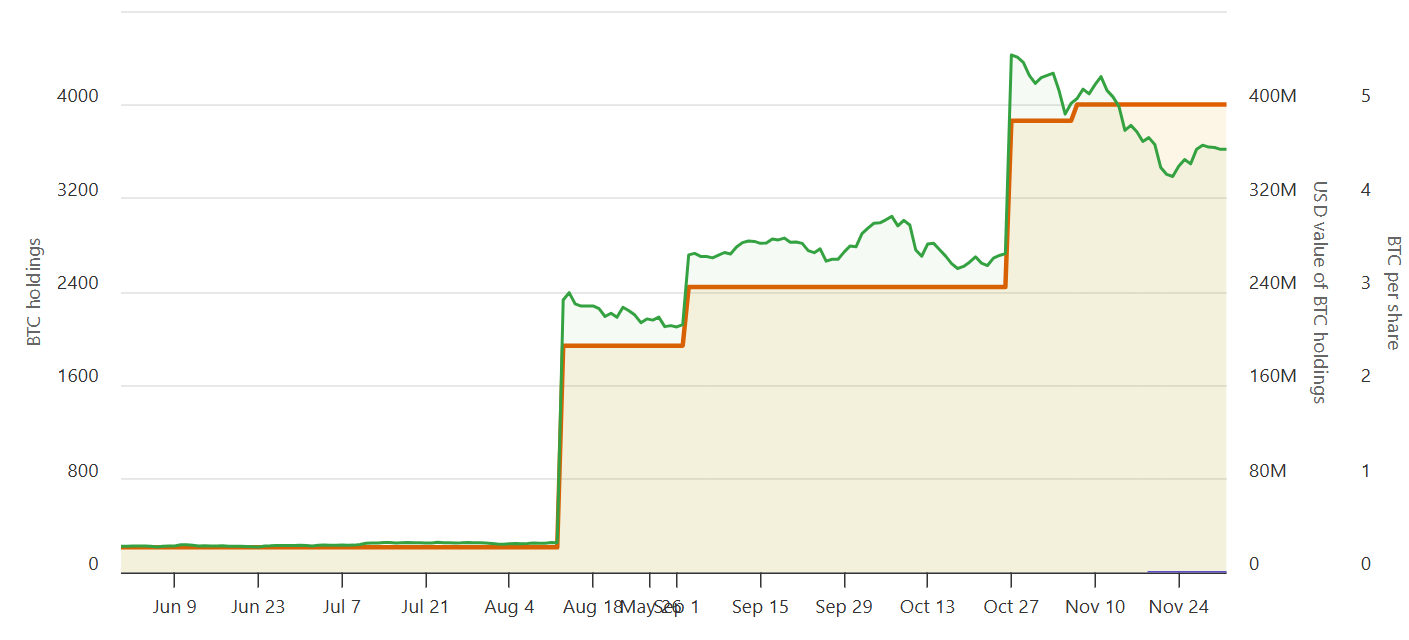

The company also added 3,000 Bitcoin to its reserves in the third quarter, lifting total holdings to more than 4,000 BTC.

American Bitcoin’s BTC accumulation. Source: BitcoinTreasuries.NET

American Bitcoin is far from alone in facing pricing pressure as Bitcoin slides. Shares of Strategy (MSTR), led by Michael Saylor, have plunged more than 50%, pushing the company’s market capitalization below the value of its Bitcoin holdings.

Eric Trump said last month that he is unfazed by the recent volatility, describing it as the “friend” of investors who value the ability to accumulate at more favorable prices.