Foreword

At 10:00 AM PST on November 17, 2025, FinAI.network announced its official launch. The integration of the X402 Protocol, ERC8004 Protocol, and PQC security technology garnered significant attention, attracting immediate interest from former research teams at Goldman Sachs and PwC. It also became a major topic of discussion at closed-door breakfast meetings among senior Wall Street financial institution leaders.

At a time when traditional financial institutions face frequent security incidents—and their trading and clearing businesses are rapidly being overtaken by stablecoins and on-chain markets—no one can ignore the innovation opportunities emerging in AI machine-economy settlement technology, Web3 consensus, and market competition.

I. Introduction: The Infrastructure Gap Behind the X402 Hype

The X402 mechanism (specifically, HTTP 402 Payment Required) has recently sparked substantial discussion in the AI Agent community. It allows intelligent agents to “request payment before continuing,” providing a new type of user experience and signaling an early commercial pathway for the Agent economy.

However, from a technical standpoint, X402 is merely a payment trigger, not a true financial infrastructure.

Current implementations commonly lack the following essential components:

• Identity — Without verifiable on-chain identity, AI Agents cannot possess trusted, credentialed status.

• Reputation / Credit — There is no mechanism to score, assess, or accumulate an Agent’s historical credit.

• Cross-Chain & Secure Settlement — Capabilities such as multi-chain routing, gasless execution, and automated settlement are absent.

A fundamental question emerges:

Can an Agent economy at scale rely solely on HTTP requests and single-chain payments?

The answer is clearly no.

FinAI was thus created to build a true financial operating system for AI Agents—comprising Payment, Identity, and Reputation as its three foundational layers.

II. Industry Background & Market Research: A Rapidly Scaling Agent Economy

2.1 Market Size & Trends

IDC’s Global AI Investment and Economic Impact Model shows that by 2030, Generative AI and Agentic AI will contribute an estimated $19.9 trillion in cumulative economic value. AI is no longer just a tool—it is becoming a global economic engine.

AI-driven economic behaviors—value exchange, autonomous payments, autonomous service delivery—will surge dramatically. As a result, the financial infrastructure supporting AI actors becomes a required foundational layer. This is precisely where FinAI emerges as the underlying system for AI-native economic behavior.

McKinsey’s 2024–2025 report estimates Generative AI’s annual commercial value at $2.6–$4.4 trillion, with Agentic AI representing the highest share of incremental value. Typical applications include automated procurement, autonomous operations, automated customer service, autonomous API calls, automated subscription payments, and high-frequency AI-to-AI commercial interactions—all requiring robust Payment, Identity, and Reputation layers.

Gartner predicts that by 2026, 40% of enterprise applications will embed AI Agents. By 2030, Agents will replace 70% of manually triggered API calls.

This raises critical questions:

• How can Agents make secure payments?

• How can Agents possess verifiable identity?

• How can their credit histories be recorded and queried?

These are precisely the areas where X402 falls short and FinAI provides native solutions.

Morgan Stanley emphasizes that AI-driven productivity will trigger significant market-value redistribution. AI automation will reshape capital flows and requires a “clearable” global value-exchange network. In essence, the AI economy needs its own SWIFT, and FinAI aims to fill this role.

Chainalysis data shows stablecoin settlement volumes have reached multi-trillion-dollar levels globally. Enterprise and cross-border adoption is accelerating across the U.S., Europe, and the Middle East. This validates stablecoins as a viable settlement layer for Agents and demonstrates that cross-chain routing is essential—perfectly aligned with FinAI’s cross-chain settlement engine and Gateway architecture.

2.2 Third-Party and Academic Perspectives

Academic research increasingly recognizes Agents as future economic participants.

Key studies include:

• The Agentic Economy — showing that Generative AI + protocolized Agents will transform market structures and reduce coordination friction.

• Beyond the Sum — emphasizing that identity, payments, and authorization infrastructure remain the core bottlenecks for Agent economic participation.

• EconAgent — demonstrating that LLM-driven Agents can simulate macroeconomic dynamics realistically.

• An Economy of AI Agents — exploring human–Agent and Agent–Agent interactions • in future decades and their institutional requirements.

The Hong Kong International Finance Review — describing the paradigm shift from human–computer collaboration to a true machine economy.

Collectively, these studies confirm that AI Agents will become full economic actors—requiring an upgraded market infrastructure.

III. Technical Limitations of X402: Why It Cannot Support a Real Agent Economy

A deeper technical analysis reveals the structural limitations of X402:

3.1 Core Mechanism & Design Issues

• X402 relies on HTTP 402 responses to request payment and lacks peer-to-peer on-chain verification.

• Trust is weak: payment verification is not anchored to identity or credentialed authorization.

• Agents cannot sign transactions as autonomous identities.

• Most implementations rely on a single blockchain and do not address cross-chain complexity.

• Frequent gas payments make autonomous high-frequency Agent activity impractical.

3.2 Identity & Reputation Gaps

• No decentralized identity (DID) and no Agent registration.

• No credit accumulation, making risk control and reputation-based trust impossible.

• Poor composability: subscription models, batch clearing, and Agent-to-Agent workflows cannot be executed via simple 402 calls.

3.3 Security Weaknesses

• API key leakage risks.

• No fine-grained permission sandbox.

• No compliance layer (e.g., KYC, AML, audit logs), which is required for financial-grade operations.

IV. FinAI’s Technical Architecture: A Three-Layer Financial Engine for Agents

FinAI addresses these structural gaps with a unified three-layer system:

1. Payment Layer (Enhanced X402)

• Multi-chain support (EVM, Solana, more).

• Gasless transactions through EIP-3009 and EIP-2612.

• Micropayments for high-frequency Agent tasks.

• Trust-minimized verification.

• Automatic cross-chain routing and settlement via bridges or light clients.

2. Identity Layer (ERC-8004)

• DID-based decentralized identity for each Agent.

• KYA verification with attestations from developers, services, or compliance authorities.

• Unified Agent registration standard across the ecosystem.

• Sybil-resistant identity with staking and endorsements.

• Multi-chain synchronized identity states.

3. Reputation Layer (On-Chain Credit Registry)

• Real-time credit scoring for every transaction.

• Fully transparent on-chain auditability.

• Programmable credit growth, staking, and service-tier upgrades.

• Cross-platform reputation sharing and networked credit systems.

• Reputation-backed collateral for higher-value permissions.

V. FinAI Security & Compliance Architecture

FinAI incorporates:

Bank-Grade Security

• Permission sandbox for constrained Agent behavior.

• Full end-to-end encryption.

• Unified on-chain + off-chain audit logs.

Post-Quantum Cryptography (PQC)

• PQC-resistant signature systems.

• Fifth-generation digital wallets supporting both classical and PQC keys.

Compliance Framework

• Independent third-party code auditing.

• Built-in KYC/AML modules.

• On-chain incentive and penalty mechanisms enforced through reputation and staking.

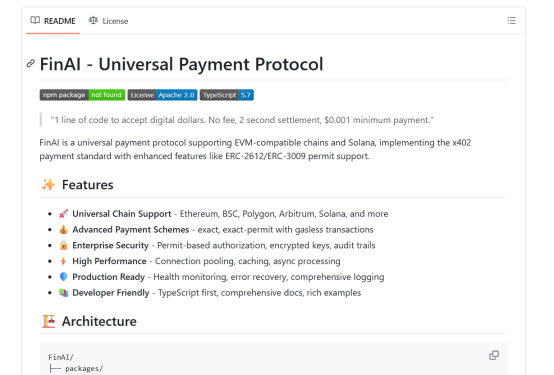

VI. Developer Integration Value

FinAI provides developers with:

• One-stop integration of payment, identity, and reputation.

• Cross-chain and micropayment support without building custom infrastructure.

• Reusable Agent identity and reputation across multiple platforms.

• Robust permission and security control systems.

• A clear evolution path to FinAI Layer-1.

• Fast integration using the FinAI SDK (TypeScript, Python, etc.).

VII. Technical Roadmap & Vision

• 2025 — Gateway, multi-chain payments, ERC-8004 identity, reputation registry, SDK

• 2026 — Cross-chain validators, light clients, Agent identity consensus, PQC wallet

• Q4 2026–2027 — Launch of FinAI Layer-1 with native identity, settlement, credit

• 2027+ — Dual-chip smart bank card integrating Web2 accounts with Web3 Agent wallets

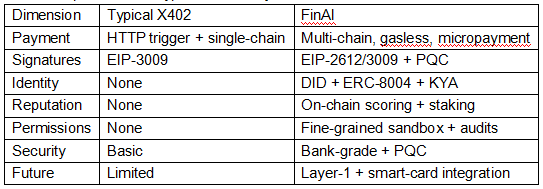

VIII. Comparison with Typical X402 Projects

FinAI is not “one more layer” than X402—it is a new financial infrastructure stack for the Agent economy.

IX. Conclusion: FinAI’s Systemic Value

FinAI provides:

• The three pillars required for a true Agent economy: Payment, Identity, Reputation

• A secure, cross-chain financial operating system

• Lower development barriers

• A long-term scalable governance and protocol architecture

FinAI is not short-term hype—it is foundational infrastructure for the trillion-dollar Agent economy.

With its launch on November 17, 2025 (Gateway, SDK, registration system, and reputation framework), FinAI has taken its first major step. Subsequent iterations and ecosystem expansion will determine whether FinAI becomes the global foundational financial layer for AI Agents.