Bitcoin spot volume spiked after the “Uptober” BTC price dip as traders sought less risky environments, according to new research.

Key points:

Bitcoin spot market trading volume hits $300 billion in volatile October 2025.

Binance leads the pack with $174 billion traded, new research reveals.

Traders are exhibiting “highly constructive” behavior regarding future market stability.

Bitcoin

exchanges saw a giant $300 billion in spot trading volume during “Uptober” 2025.

New data from the onchain analytics platform CryptoQuant shows that despite BTC price lows, the market remains “healthy.”

Binance leads Bitcoin spot volume rebound

Bitcoin exchanges experienced no let-up in spot trading volume this month, despite the price dropping nearly 20% from its all-time high.

Gathering spot-market data from across global exchanges, CryptoQuant reveals that, so far in October, the total spot volume tally exceeds $300 billion.

“This October has seen a renewed surge of interest in the spot market, particularly on Binance,” contributor Darkfost wrote in one of its “Quicktake” blog posts.

“Major exchanges recorded more than $300B in Bitcoin spot volume this month, with $174B coming from Binance alone, making it the second-highest month of the year.”

Bitcoin spot trading volume. Source: CryptoQuant

The figures are important for Bitcoin bulls, as a spot-driven market tends to become more resistant to short-term volatility than one where derivatives account for the majority of volume.

“This trend highlights growing participation from both retail traders and institutional players, who appear increasingly active on the spot side,” Darkfost added.

BTC spot volume trend “highly constructive”

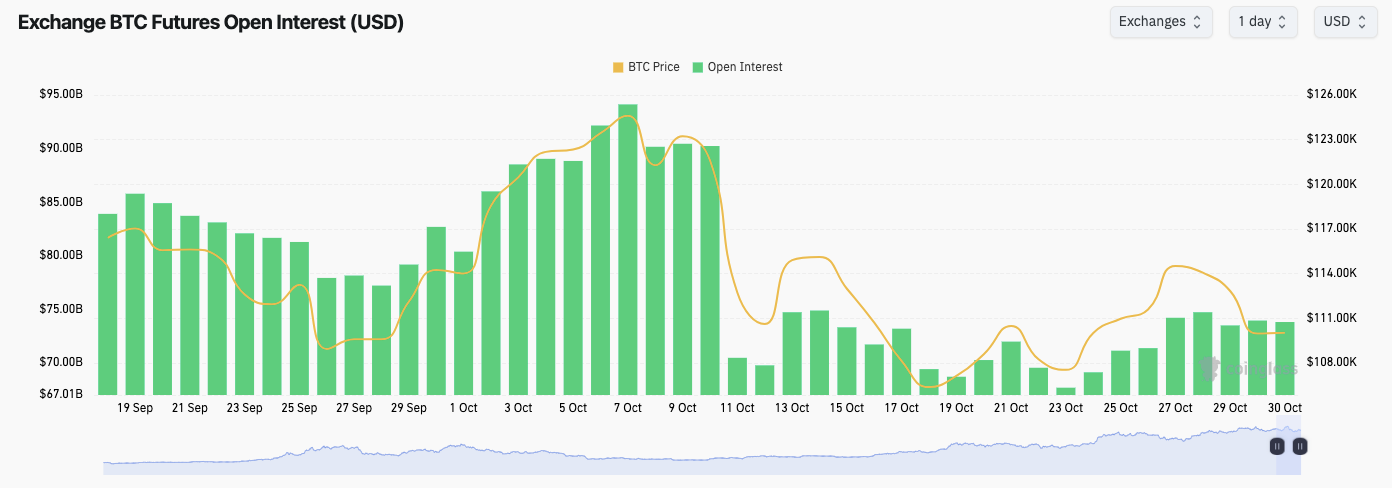

As Cointelegraph reported, Bitcoin’s rapid descent from all-time highs earlier in the month wiped out a significant chunk of derivatives open interest (OI).

Related: Bitcoin vs. history: BTC price teases 7% gains as ‘golden week’ ends

Bitcoin futures open interest (screenshot). Source: CoinGlass

The event also liquidated a record $20 billion of long and short positions, with commentators suspecting that the actual total was far higher.

CryptoQuant now argues that traders have shifted back to spot markets as a result.

“This is a highly constructive signal,” the blog post concluded.

“A market driven more by spot trading rather than derivatives is generally healthier, more stable, as it less vulnerable to extreme volatility driven by excessive open interest expansion. It also reflects stronger organic demand and greater overall market resilience.”

Since the dip, leveraged traders have variously won and lost big as a result of market fluctuations.