MetaMask is partnering with Polymarket to offer all markets on the prediction platform, with the integration slated for later this year.

Crypto wallet MetaMask will tap Polymarket later this year to expand its offerings to prediction markets, aiming to get in on the booming sector that has caught Wall Street’s attention.

The integration will make Polymarket directly available through MetaMask’s wallet, enabling users to buy and sell “shares” to bet on real-world events from elections and sports to a company’s earnings results.

MetaMask’s global product lead, Gal Eldar, told Cointelegraph that the partnership is part of the firm’s goal to evolve from a crypto wallet into a gateway to global, democratized finance.

“Each new feature expands what users can do with their financial assets: trade, earn, invest, speculate, and diversify, all while maintaining full self-custody,” he said.

The prediction markets on the Consensys-built MetaMask are being rolled out everywhere except the US, UK, France, Singapore, Poland, Thailand, Australia, Belgium, Taiwan and Ontario, Canada.

Prediction markets have become one of crypto’s hottest use cases, with adoption accelerating considerably around the time of the US election in November 2024.

Wall Street is also paying attention, with Polymarket getting a $2 billion investment from New York Stock Exchange parent company, Intercontinental Exchange, on Tuesday, which valued the platform at $9 billion.

Prediction market volumes cool

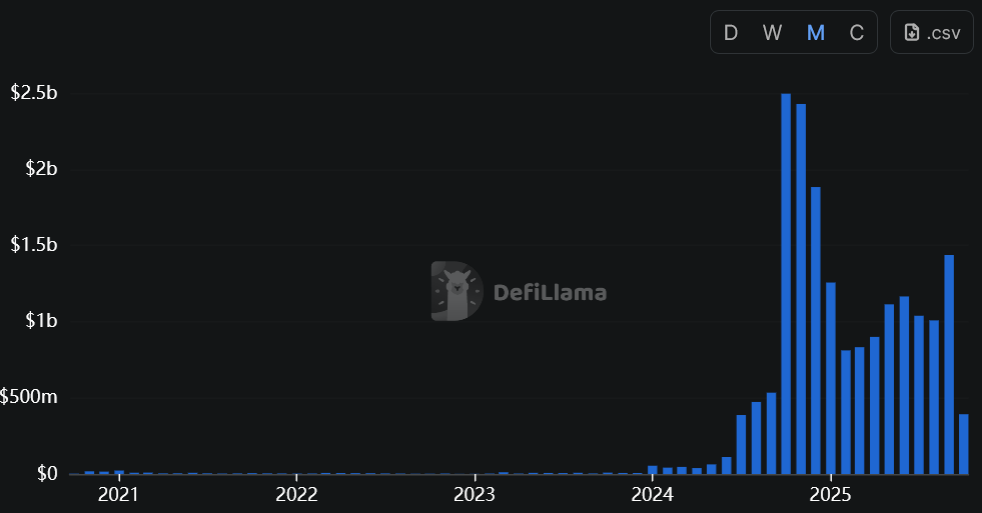

Trading volumes on prediction markets have cooled from their highs, but the two largest prediction market platforms, Polymarket and Kalshi, respectively saw $1.43 billion and $2.74 billion in volume in September, surpassing their previous combined record last November, DefiLlama data shows.

Polymarket’s monthly change in trading volume since October 2020. Source: DeFiLlama

Despite the volume of trades cooling, Eldar said that prediction markets are still one of the most powerful on-chain primitives because they’re “fundamentally about truth-seeking.”

“When incentives are aligned and participation is broad, markets become self-correcting systems that push us closer to reality. The deeper and more liquid they get, the faster they converge around the truth.”

MetaMask integrates Hyperliquid for perps trading

It comes as MetaMask also launched perpetual futures through an integration with Hyperliquid on Wednesday as it seeks to capture market share away from centralized exchanges in the booming perps market.

Related: Jameson Lopp: Most don’t realize how easy self-custody has become

Decentralized perps trading volume has exploded recently, tallying around $770 billion over the last month, with Hyperliquid leading the charge.

However, those figures still pale in comparison to what centralized exchanges such as Binance generate, in part due to offering a simplified user experience.

MetaMask hopes its new feature improvements will give its users a more centralized exchange-like experience while benefiting from the security benefits that decentralized platforms offer.