Stablecoin issuer Circle has partnered with crypto infrastructure and self-custody platform Crossmint to offer USDC across more chains for both humans and AI agents.

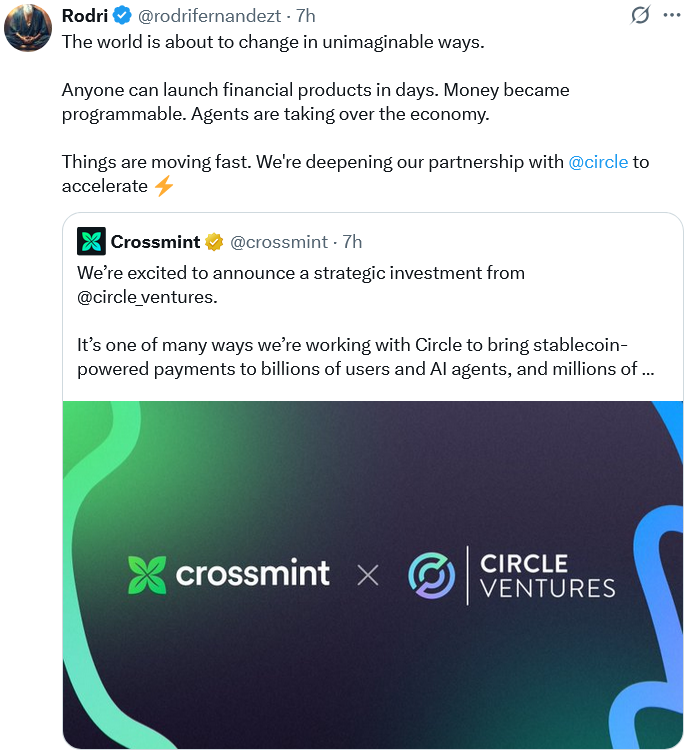

Stablecoin company Circle’s venture capital arm has partnered with crypto infrastructure firm Crossmint to expand the USDC stablecoin across more blockchain rails as part of its aim to reach billions of users, including AI agents.

“By combining Crossmint Wallets and APIs for stablecoin onramps, orchestration, and agentic payments with USDC [...] we’re laying the foundation for a new era of finance: one where money moves near-instantly, access is global, and systems are built for both humans and machines,” Crossmint said on Wednesday as it announced the partnership with Circle Ventures.

Source: Rodri Fernandez Touza

Crossmint’s support for AI agents comes amid rising anticipation that they will eventually become Ethereum’s “biggest power user,” unlocking countless opportunities for e-commerce apps onchain.

Two members of Coinbase’s development team, Kevin Leffew and Lincoln Murr, said that AI agents will leverage stablecoins to do everything from paying costs for self-driving taxis to publishing content on demand and apps automatically using stablecoins to store data permanently.

Stablecoin rails offer lifelines in inflation-hit countries

Meanwhile, people in unstable, high-inflation countries are increasingly turning to stablecoins to secure their wealth, including in Argentina, where many use “crypto caves” to buy US dollar stablecoins in a bid to escape strict currency controls and high inflation.

Last week, MoneyGram announced that its crypto payments app — which leverages Crossmint’s infrastructure and self-custody solution — would launch in Colombia, offering a new way for locals to receive and store USDC

as an alternative to the weakening Colombian peso.

Related: Circle and OKX launch zero-fee USDC conversions to US dollar

MoneyGram already serves over 50 million customers across more than 190 countries, thus expanding the number of customers who can rely on Crossmint’s technology to save in stablecoins.

USDT still dominates stablecoin payments

Despite the partnerships leveraging Circle’s USDC, Tether

remains the most widely used stablecoin. It has seen nearly $100 billion in trading volume alone in the last 24 hours — nearly ten times more than USDC’s $10.3 billion, CoinGecko data shows.

USDT’s $173 billion market cap also sits comfortably above USDC’s $74.1 billion.

The USDT supply on the Tron network surpassed $80 billion in June, with its fast, low-cost transfers making it an ideal option for sending digital dollars in developing countries.

Crossmint announced another partnership earlier this week

Crossmint also partnered with the team behind layer-1 payments-focused blockchain Tempo on Tuesday as part of its broader push to drive stablecoin adoption.

Tempo was incubated by payments infrastructure platform Stripe, which handled over $1.4 trillion in volume in 2024, and crypto investment firm Paradigm.