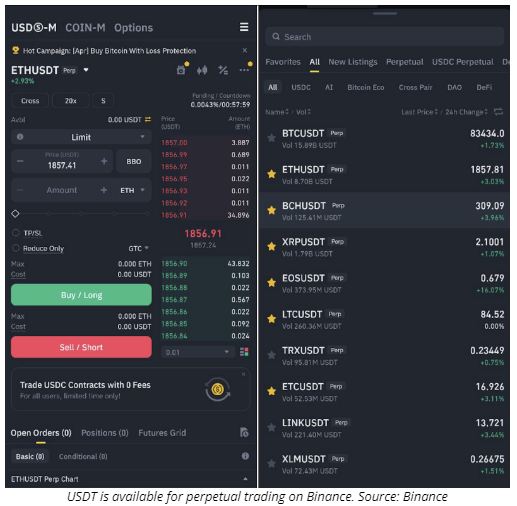

European Economic Area users can still custody non-MiCA-compliant tokens, such as Tether’s USDt, and trade them in perpetual contracts.

Binance has discontinued spot trading pairs with Tether’s USDt in the European Economic Area (EEA) to comply with the Markets in Crypto-Assets Regulation (MiCA).

Cryptocurrency exchange Binance has delisted spot trading pairs with several non-MiCA-compliant tokens in the EEA in line with a plan disclosed in early March, Cointelegraph has learned.

While spot trading pairs in tokens such as USDt are now delisted on Binance, users in the EEA can still custody the affected tokens and trade them in perpetual contracts.

According to a previous announcement by Binance, the spot trading pairs for non-MiCA-compliant tokens were to be delisted by March 31, which is in line with a local requirement to delist such tokens by the end of the first quarter of 2025.

Delistings on other exchanges in EEA

Binance is not the only crypto exchange delisting non-MiCA-compliant tokens for spot trading in the EEA.

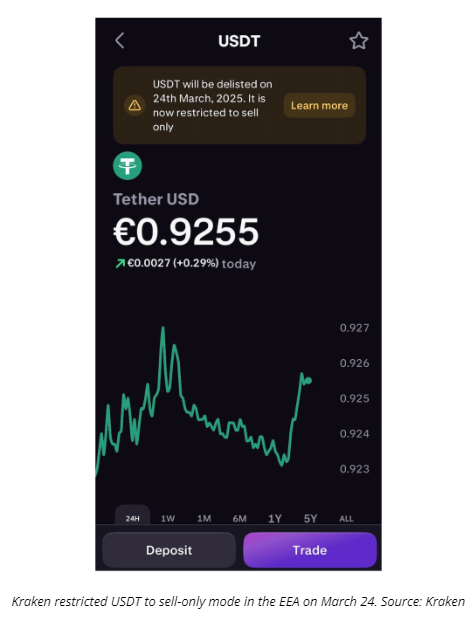

Other exchanges, such as Kraken, have delisted spot trading pairs in tokens such as USDT in the EEA after announcing plans in February.

According to a notice on the Kraken website, the exchange restricted USDT for sell-only mode in the EEA on March 24. At the time of writing, the platform doesn’t allow its EEA users to buy the affected tokens.

Among other non-MiCA-compliant tokens, Binance has also delisted spot trading pairs for Dai , First Digital USD , TrueUSD , Pax Dollar , Anchored Euro (AEUR), TerraUSD (UST), TerraClassicUSD and PAX Gold .

Related: Tether acquires 30% stake in Italian media company Be Water

Kraken’s delisting roadmap in the EEA only included five tokens: USDT, PayPal USD , Tether EURt (EURT), TrueUSD and TerraClassicUSD.

ESMA doesn’t prohibit custody of non-MiCA-compliant tokens

Binance and Kraken’s move to maintain custody services for non-MiCA-compliant tokens aligns with a previous communication from MiCA compliance supervisors.

On March 5, a spokesperson for the ESMA told Cointelegraph that custody and transfer services for non-MiCA-compliant stablecoins do not violate the new European cryptocurrency laws.

On the other hand, the same regulator previously advised European crypto asset service providers to halt all transactions involving the affected tokens after March 31, adding a certain extent of confusion over MiCA requirements.