What Sparks Emerge When Ancient Artifacts Meet Modern Technology?

In the era of Web 3.0, a wave of financial innovation in Hong Kong is allowing "museum-grade assets" to break barriers and experience a renaissance. The focus of this article, the LANT platform, leverages blockchain and RWA (Real-World Asset Tokenization) technology to transform physical assets like the ancient artifact Lantingji Xu into digital assets, reshaping the flow of value in cultural heritage. This transformation is not only a tribute to history through technology but also an experiment in the democratization of finance — ordinary investors can hold rights to cultural heritage assets through tokens and share in the appreciation of these assets. As a result, the traditionally "exclusive" art market is now moving toward the masses.

Hong Kong, as a global policy hub for RWA, is paving the way for such innovations with open regulation and million-dollar subsidies, and LANT’s practice is a typical product of this environment. However, beneath the excitement of technological innovation, we must also remain vigilant: How can the authenticity of assets be verified? Can DAO governance truly break the “scam cycle”? These issues point to the core challenges of the RWA wave — compliance and technological trust.

As history flows forward, the digital awakening of cultural heritage is not just a financial issue but a contemporary question of civilization’s continuity. Perhaps, much like the immutable nature of blockchain, technology’s other side is quietly writing the answers to our future.

Lead: When Emperor Qianlong’s enamel porcelain is digitized into a blockchain certificate, and Michelangelo’s sketch is valued and priced through a DAO (Decentralized Autonomous Organization) vote, this seemingly sci-fi scenario is becoming a reality in a glass-walled building in Hong Kong. A digital financial platform named LANT is transforming cultural relics and artworks from private museums around the world into "magic bottles," turning them into digital assets that anyone can invest in.

01 Lantingji Xu "Draws Its Sword": The Crypto Experiment Awakens the Value of Cultural Relics

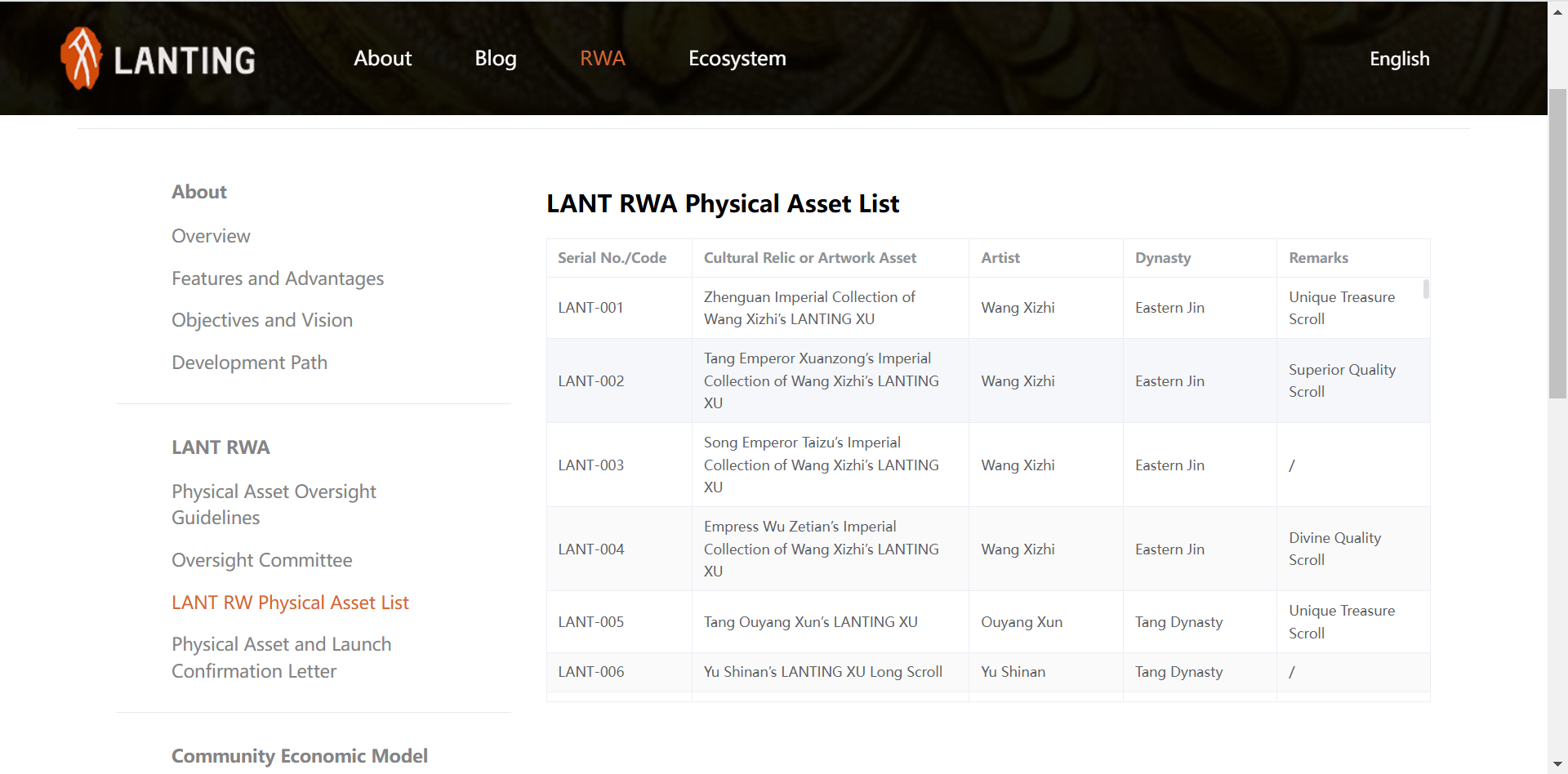

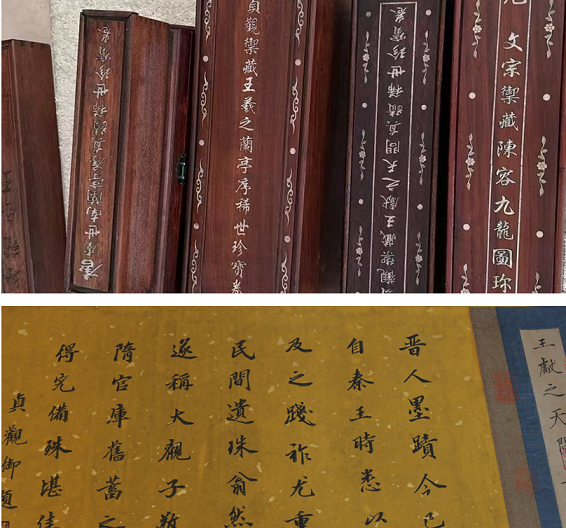

In January 2025, the original manuscript of Lantingji Xu, sealed away for over 1,200 years, was prominently featured in the LANT platform’s list of cultural asset tokens. This scroll, once hidden in a private collection in Taiwan, became one of the anchor assets in the platform's first "Cultural Relic Digital Asset Package." At the same time, the first batch of 1 billion LANT TOKENS, valued at $1 billion, was minted, reducing the investment threshold from millions of dollars to just $1.

The founders of LANT come from a private museum collection in Taiwan. They discovered that, in the global $1.7 trillion cultural relics and art market, 95% of the assets are "frozen" — high authentication barriers, poor liquidity, and access restricted to a very few collectors. The platform uses blockchain to complete a tripartite rights confirmation: the Cultural Relics Authentication Committee confirms authenticity, the DAO-based Cultural Relics Supervision Committee evaluates and sets the price, and blockchain smart contracts create the terms, constructing a digital asset framework that moves from Web 2.0 to Web 3.0, offering high premiums and liquidity.

02 Ten-Fold Financial Engine: Making Cultural Assets Continuously Appreciate

In LANT's technical white paper lies a game-changing formula that has stunned traditional finance — a compound yield system built from 10 mechanisms, including the physical asset deflation model, dynamic pricing protocol, and stablecoin incentive pools. When physical assets are auctioned and traded, smart contracts automatically trigger buyback and burn contracts, forcing the assets into deflation to drive value appreciation. At the same time, auction premiums on physical assets will actively complete buyback incentives, providing liquidity for the digital asset’s appreciation. Furthermore, when new cultural relics are added to the blockchain, DAO community voting unlocks the incentive pool, further boosting the overall value. This design creates high-premium market opportunities for the platform’s initial $1 billion in cultural assets.

The confidence in this model comes from the unique patterns of the art market: Over the past 50 years, cultural relics and artworks have delivered an annualized return of 10.6%, far surpassing the S&P 500 index. When digital financial tools meet the never-depreciating value of cultural hard currency, an astonishing chemical reaction occurs.

03 Hong Kong's "Crypto Sandbox": The Institutional Key to the RWA Revolution

The Hong Kong Monetary Authority’s Ensemble regulatory sandbox project has fast-tracked this transformation. Under the experimental policy framework, the LANT platform will enjoy two major privileges: compliant tokens will circulate freely in the interbank clearing system, and DAO governance will hold the same legal status as asset management companies. This allows cultural relic tokens to connect both with traditional trust funds and decentralized finance (DeFi) protocols like UniSwap for liquidity.

The Hong Kong Financial Services and the Treasury Bureau has further rolled out a "triple firepower" approach: subsidies covering 50% of audit costs for digital bond issuance, exemption from VAT for cross-border payments, and the establishment of the world’s first RWA dispute arbitration court. Under these policies, Hong Kong’s RWA trading volume is expected to surpass $10 billion in the first quarter of 2025, with cultural relics and artworks accounting for more than 40% of the total.

04 The Navigational Code of the Wealth Age

When a Wall Street hedge fund manager exchanges 32 RWA tokens for digital rights to ancient Roman coins, or when a Singaporean family office allocates 10% of its assets to Dunhuang mural RWA tokens, the underlying logic of wealth movement has fundamentally changed.

05 Conclusion: Digital Flow Activates Economic Value

Physical forms safeguard the genes of civilization, while digital flow activates economic value. The emergence of the LANT platform and the rise of RWA technology herald a new era — cultural relics and artworks are no longer the exclusive domain of a few, but can be digitized into "light assets" — cultural digital assets — that appeal to young people, making their way into Gen Z's digital wallets and physical cards, breathing new life into these treasures.

Here lies a blockchain-exposed time capsule spanning millennia, and a newly defined value coordinate system reimagined by digital civilization. The lights across Hong Kong’s Victoria Harbour are now illuminating the global path to the revitalization of Eastern civilization’s cultural digital assets.

【Disclaimer】: This article explores the LANT RWA financial innovation model and does not represent the official views or investment advice of the LANT platform.