Some 20 US states are mulling creating Bitcoin reserves, and so is the federal government.

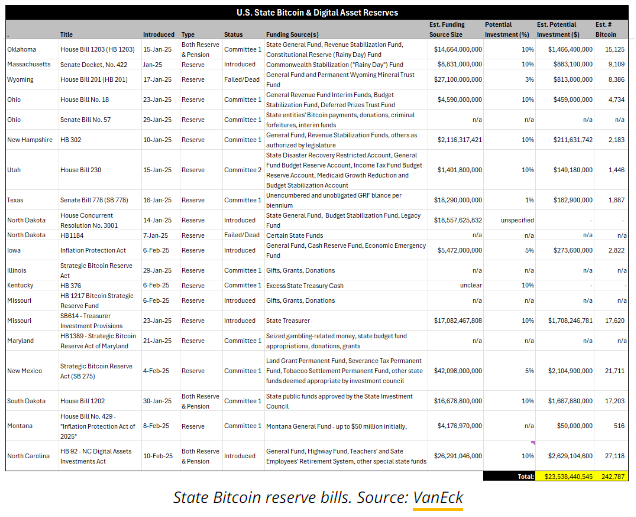

Proposed laws to create strategic Bitcoin (BTC) reserves in American states could drive as much as $23 billion in demand for BTC if passed, according to an analysis by asset manager VanEck.

VanEck analyzed 20 state-level Bitcoin reserve bills and found they would require state governments to collectively buy approximately 247,000 BTC if enacted, Matthew Sigel, VanEck’s head of research, said in a Feb. 12 post on the X platform.

The analysis does not include potential BTC purchases by state pension funds, Sigel said. Adding BTC to state retirement funds would spur demand even further.

“This $23b number is potentially conservative, given the lack of details (many of these states are ‘n/a’ with size unknown),” Sigel noted.

Related: Bitcoin’s role as a reserve asset gains traction in US as states adopt

Burgeoning demand

Bitcoin is tracking toward “becoming a mainstream reserve asset” thanks to growing institutional and government adoption, Isaac Joshua, CEO of crypto startup platform Gems Launchpad, told Cointelegraph on Feb. 9.

In addition to state governments, US President Donald Trump ordered staff to explore a potential national strategic Bitcoin reserve.

Meanwhile, more than 150 companies are accumulating Bitcoin treasuries, citing the cryptocurrency’s perceived utility as an inflation hedge, according to data from BitcoinTreasuries.NET.

In February, Trump ordered the creation of a sovereign wealth fund, which industry analysts speculate could serve as a vehicle for the US government to buy BTC.

On Jan. 16, the New York Post reported that Trump is receptive to expanding a possible reserve to include a broader basket of cryptocurrencies, such as USD Coin (USDC), Solana (SOL) and XRP (XRP).

Prediction market Kalshi ascribes 52% odds that Trump will follow through on creating a national Bitcoin reserve this year.

Establishing BTC reserves in the US would accelerate Bitcoin’s adoption even more than 2024’s exchange-traded fund (ETF) launches, cryptocurrency researcher CoinShares said in a Jan. 10 blog post.

“We believe that the enactment of the Bitcoin Act in the United States would have a more profound long-term impact on Bitcoin than the launch of ETFs,” CoinShares said.