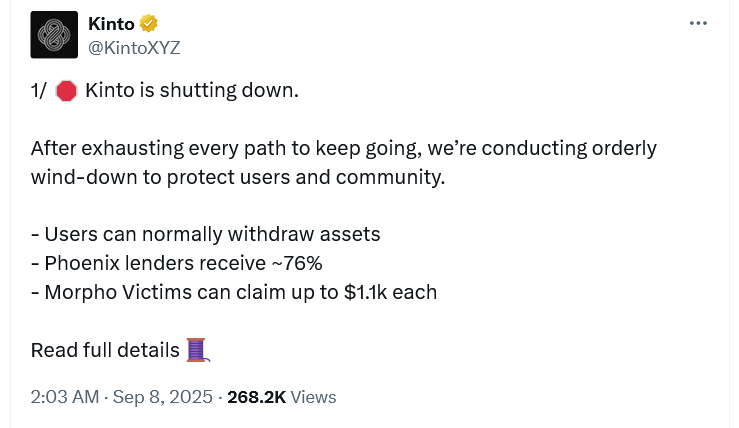

Ethereum layer-2 Kinto’s token plummeted after its team announced its blockchain would wind down on Sept. 30, months after a $1.6 million hack.

The Kinto token, the governance token of the Kinto Network, has plummeted over 80% after its team announced that its Ethereum layer-2 blockchain is shutting down at the end of September, following months of setbacks.

Kinto raised $1 million in debt to restore trading on its “modular exchange” after an industry-wide hack in July drained about 577 Ether

worth around $1.6 million from the protocol.

However, worsening market conditions “killed further fundraising,” forcing the crypto project to shut down, Kinto posted to Medium on Sunday.

“Every day that we go on, the funds dwindle further. We’ve operated without salaries since July, and after the last financing path fell through, we have one responsible choice left: shut down cleanly and protect users/lenders as best as possible.”

Source: Kinto

The $1.6 million hack resulted from a security vulnerability in the ERC-1967 Proxy standard — a common OpenZeppelin codebase that allows smart contracts to be upgraded without changing their address. Several other projects were also affected.

While Kinto blamed the failure on the hack and rising financial pressures, one onlooker pointed to Kinto’s excessively high annual percentage yield offerings on stablecoins, even at times after the hack when they were struggling to make revenue.

One of Kinto’s founders, Ramon Recuero, noted in April that K staking offered a 130% annual yield in USDC

— one of the highest in the entire DeFi space. Other decentralized finance platforms with high yields have had rocky pasts.

The project, which was built on Arbitrum and leverages the Ethereum mainnet for settlements, also offered trading of tokenized stocks like Apple, Microsoft and Nvidia.

Its modular exchange attempted to combine the efficiency of centralized exchanges with the security features offered by decentralized exchanges.

Kinto unveils recovery plan

Kinto said all remaining assets — including $800,000 of Uniswap liquidity — will be distributed to the “Phoenix” lenders who helped Kinto relaunch. They are expected to recover 76% of their loan principal.

Kinto and Recuero are also setting up a “goodwill grant” for victims of the hack, each receiving $1,100 per affected address. Recuero said he will contribute more than $130,000 of his own funds to provide relief.

Kinto said it will continue to recover lost assets and that if recoveries exceeded victim amounts, it would share that with the community via Snapshot, a voting platform typically used by decentralized autonomous organizations.

The Kinto team urged users to withdraw assets by Sept. 30. After that, they would need to claim any assets through a perpetual claim contract that Kinto plans to create.

Kinto is Recuero’s second failed crypto project

Kinto marks Recuero’s second crypto venture to shut down, following Babylon Finance, which closed in November 2022 after it fell victim to a $3.4 million hack earlier that year.

Recuero similarly said at that time that his team wasn’t “able to revert the negative momentum” caused by the hack, forcing Babylon to shut down just six months after its public launch.

Related: Ethereum L2 Starknet suffers 2nd mainnet outage in 2 months

K token falls nearly 80%

Kinto (K) has tanked 81.4% to $0.46 since the team announced the news, with its market cap barely hovering above the $1 million mark, CoinGecko data shows.

The fall comes almost a month after reaching an all-time high of $14.5 million on Aug. 14. The Kinto token launched just four months ago in April.

Change in market cap of Kinto since March 31, 2025. Source: CoinGecko