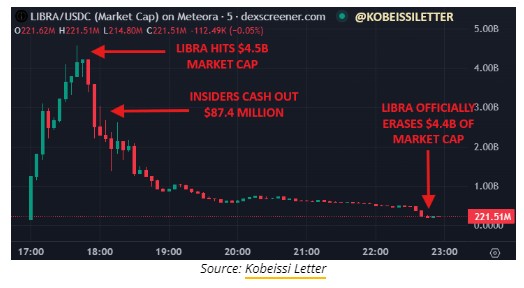

Insider wallets started cashing out just three hours after the token was launched, erasing over $4 billion from its market capitalization.

The launch of Libra (LIBRA), a cryptocurrency endorsed by Argentine President Javier Milei, turned into a financial catastrophe after insiders cashed out over $107 million, wiping out nearly 94% of the token’s value within hours.

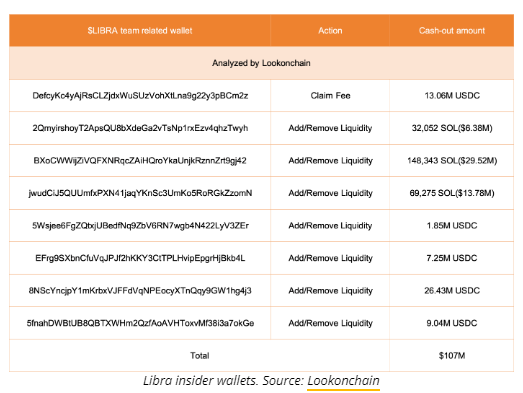

According to onchain intelligence firm Lookonchain, at least eight wallets linked to the Libra team siphoned liquidity from the token, pocketing 57.6 million USD Coin and 249,671 Solana worth $49.7 million:

“The $LIBRA team has cashed out $107M! 8 wallets related to the $LIBRA team have obtained 57.6M $USDC and 249,671 $SOL($49.7M) by adding liquidity, removing liquidity and claiming fees.”

The Libra token briefly rose to a peak market capitalization of $4.56 billion at 10:30 pm UTC on Feb. 14 before falling over 94% to the current $257 million market cap in just 11 hours since the token debuted for trading on decentralized exchanges, Dexscreener data shows.

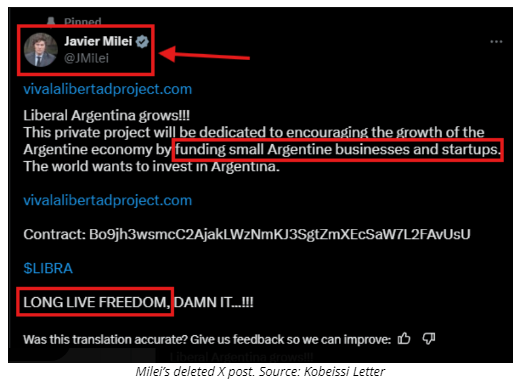

The token’s rally began shortly after a now-deleted X post from President Milei, which shared a website and token contract address for Libra, which was a “private project” dedicated to “encourage the growth of the Argentine economy.”

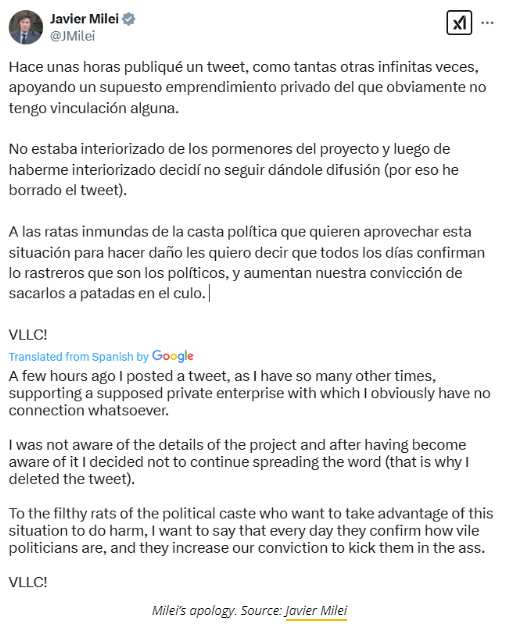

After the token’s collapse, Milei deleted his endorsement, later issuing a statement on X blaming political opponents:

“To the filthy rats of the political caste who want to take advantage of this situation to do harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the ass.”

Retail investor appetite for celebrity-endorsed memecoins has been boosted since US President Donald Trump launched his Official Trump (TRUMP) memecoin on Jan. 18, followed by First Lady Melania Trump’s Melania Meme (MELANIA) token on Jan. 19 on the Solana network ahead of his inauguration on Jan. 20.

Related: Bitcoin price could reach $1.5M by 2030 — Cathie Wood

LIBRA erases over $4 billion from market cap after insider selling

Insider wallets started cashing out on the token only three hours after it debuted for trading, causing its over 94% decline, according to data shared by the Kobeissi Letter.

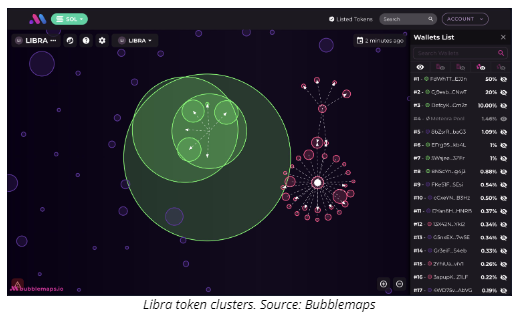

Other blockchain data firms have warned about the project’s tokenomics even before the meltdown. Blockchain analysis firm Bubblemaps had warned about LIBRA’s flawed tokenomics, revealing that 82% of the supply was unlocked and sellable from the start.

Moreover, the project shared no preliminary information about its tokenomics, a major red flag among crypto traders.

Related: Analysts predict delayed altcoin season amid lack of retail traders

Yet, some of the savviest crypto traders can successfully navigate through the volatility of memecoins despite their intrinsic lack of utility.

On Feb. 14, a savvy crypto “sniper” made $28 million in profit after buying the latest “Broccoli” memecoins inspired by Binance co-founder Changpenz Zhao’s dog. However, speculation has arisen that the trader may have been an insider wallet.