XRP’s price surged amid broader uncertainty in the crypto market, driven by aggressive whale accumulation and speculation about a possible ETF listing in the US, according to crypto analysts.

XRP’s price surged 12% in a day with data showing whales have been accumulating the asset in significant volumes, speculation around an ETF listing in the US and optimism toward President-elect Donald Trump’s looming inauguration.

“XRP investors are pleased to see the #3 market cap asset reach $2.69 today for the first time since Dec. 17, 2024,” crypto analysis firm Santiment said in a Jan. 14 X post.

At the time of publication, XRP had surged further, trading at $2.83, a price not seen since early 2018, according to CoinMarketCap data.

XRP whale accumulation is gaining momentum

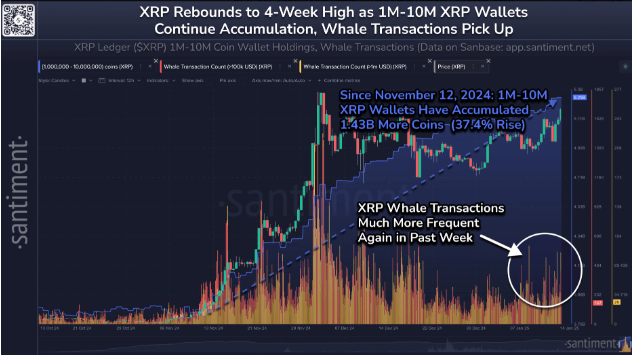

Santiment said that XRP’s price increase could be attributed to the “continued enormous accumulation” from wallets holding between 1 million and 10 million XRP tokens.

The analysis firm said that since Nov. 12, the cohort had accumulated 1.43 billion XRP tokens, marking an increase of about 37.4%.

Onchain protocol Derive’s head of research, Sean Dawson, told Cointelegraph that XRP’s strong momentum is “most likely due to a possible XRP ETF listing sometime this year.”

Dawson said that as Bitcoin “gets bought up,” investors may be inclined to rotate capital into altcoins like XRP, further “fuelling bullish sentiment.”

Blockchain-focused media company Gokhshtein Media founder David Gokhshtein said in a Jan. 15 X post, “XRP holders deserve this.”

XRP’s price saw tight consolidation throughout 2024, with the price difference between Jan. 17 and Oct. 17 being just 3.8%.

SEC deadline to file an appeal cited as “another factor”

“XRP’s legal battles with the SEC could also come to a head this year in the former’s favor,” Dawson added.

Related: Ripple execs lash out at SEC’s refusal to postpone appeal filing

Dawson said while he expects the SEC to appeal the case, it will be against a backdrop of “pro-crypto sentiment” in the White House and “will likely trickle down to SEC appointees and their subsequent enforcement.”

Meanwhile, banking giant JPMorgan projected that Solana and XRP ETPs may eclipse the performance of spot Ether ETFs in their first six months of trading.

“When applying these so-called “adoption rates” to SOL and XRP, we see SOL attracting roughly $3 billion-$6 billion of net assets and XRP gathering $4 billion-$8 billion in net new assets,” JPMorgan said in a Jan. 13 report.