Just how high can Ethereum go? That’s the question we’re all asking ourselves as the number two cryptocurrency by market capitalization is vaulting to unprecedented all-time price highs in Q4 2017.

And as it stands right now, it really looks as if Ethereum and its associate fuel “Ether”have unlimited adoption potential in the decades ahead.

That’s because if Bitcoin’s appeal is as “digital gold,” then Ethereum’s appeal should be as the crypto revolution’s Microsoft 2.0. That’s because you can build a seemingly limitless number of utilities atop of Ethereum. To this end, civilization itself may be running atop Ethereum in a handful of years if the project can live up to is promise.

With these theme in mind, let’s dig a little deeper.

What is the Flippening?

Contents [show]

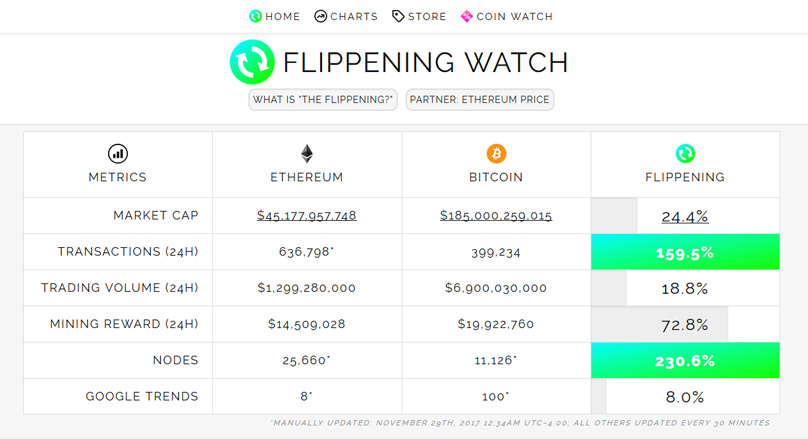

To Ethereum enthusiasts, the so-called “flippening” is the day in which ETH overtakes Bitcoin as the crypto with the highest market cap. Essentially, then, the day in which ether becomes the #1 crypto.

Could it happen? Without a crystal ball, no one knows for sure right now. But what is clear is that however much of a “darkhorse” any cryptocurrency is at the moment ETH is one of the best positioned cryptos to one day overtake BTC.

To be clear, we’re not saying that will happen. But we are saying it’s possible.

One crucial factor to consider is the politics of the cryptocurrency space. Bitcoin bills itself as a “currency.” This automatically puts it in a position to be in competition with governments who mint their own currencies. And as BTC continues to make traditional currencies more pointless, some governments may want to lash out and crackdown on accordingly.

Whether these governments could succeed in hampering Bitcoin effectively is certainly up for debate.

But Ethereum bills itself in a different way that should allow it to avoid this antagonistic dynamic altogether. That’s because ETH is designed as a scarce network fuel. Likewise, the Ethereum project can sincerely avoid the legal and regulatory regulations of being a currency-killer while being a de facto currency.

In other words? Ethereum may end up having its cake and eating it, too.

In this light, Ethereum may be a safer bet at present even if Bitcoin were to continue to explode unchallenged in the years ahead, ETH’s future seems significantly less cloudy from a regulatory point of view.

Factor for Growth? The “Fuel” Dynamic

In a certain way, ether is loosely akin to traditional commodities like oil and gas because ETH has a fuel-like function on the Ethereum network.

In the future, then, ether should continue to appreciate in value as “digital oil” for the blooming Ethereum network that one day may revolutionize society from the ground up.

Just like there was an “oil rush” for so-called black gold in the 1800s, so too is there shaping up to be an “ether rush” in the 2000s.

Another Major Perk: Proof of Stake

The Proof of Work (PoW) protocol has been proven to work after years of successfully powering the Bitcoin network. Considerably more unproven? Proof of Stake (PoS).

The Proof of Stake model makes it so that mining will be come moot as “stakers” take their place. Stakers are just holders who will hold their ether in specialized stake wallets. The staked ether, then, will be used to verify and “stamp” transactions on the Ethereum network, a task that was previously left to miners.

What’s so lucrative about this dynamic is that it will then be stakers who are paid to maintain the Ethereum network, not miners. Stakers will be rewarded in ETH annually for helping to guarantee the network.

This could be majorly decentralizing, in that people won’t need to go out and buy expensive, specialized mining gear to become validators, instead, they’ll just need to buy some ETH and be holders, which most of us are right now anyways.

This could be an incredibly attractive selling point for the entire Ethereum project in the coming years, as users may clamor to become rewarded as stakers. And this dynamic may even contribute to the aforementioned flippening if enough users are won over by PoS.

For now, though, Ethereum’s staking system is still several months away. But it’s certainly something to keep an eye on.

Enterprise Ethereum Alliance

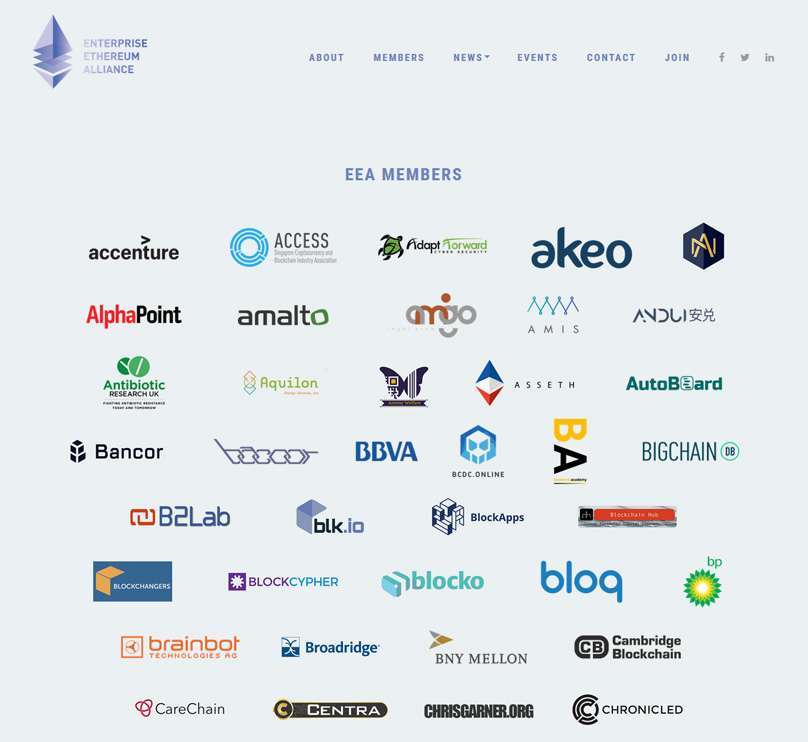

The EEA, as it’s better known, is an association of companies who are working with the Ethereum community to experiment and learn about Ethereum.

In the Alliance’s own words, it’s mission is as follows:

“The Enterprise Ethereum Alliance connects Fortune 500 enterprises, startups, academics, and technology vendors with Ethereum subject matter experts. Together, we will learn from and build upon the only smart contract supporting blockchain currently running in real-world production – Ethereum – to define enterprise-grade software capable of handling the most complex, highly demanding applications at the speed of business.”

Standouts in the Alliance include:

§ BP

§ Cisco

§ Credit Suisse

§ HP Enterprise

§ Intel

§ J.P.Morgan

§ Microsoft

§ The National Bank of Canada

§ Samsung SDS

§ Stanford Law School

§ UBS

§ U.S. Coast Guard

As these companies are ahead of the curve, others surely will follow. Which could help to power Ethereum’s unprecedented adoption in the future. No other cryptocurrency project is boasting partnerships like this so early on.

The Nasdaq and CFTC’s bitcoin futures are impressive. But having Microsoft and Intel tinkering around with Ethereum is in the same ballpark.

Macro trader Mike Novogratz Thinks $1500 ETH Is Coming Soon

Former Fortress hedge fund maestro Michael “Mike” Novogratz has really become something of a cheerleader for the Ethereum community in recent weeks. Novogratz is already a legend in the community for buying 500,000 ETH when they were still $1 USD each. Appearing commonly on CNBC to discuss crypto, Novogratz forecast ETH hitting $500 just weeks ago — which it did at the end of November 2017.

Now, in an even newer interview with CNBC, Novogratz just said that he sees $1500 ETH materializing before the end of 2018.

“Bitcoin could be at $40,000 at the end of 2018. It easily could. And I think Ethereum, which I think just touched $500 or is getting close, could be triple where it is as well.”

That would be nice, wouldn’t it?

The man who called #bitcoin $10K back in October now sees this @novogratz

492 people are talking about this

That would be a 200 percent increase in value from where ETH is sitting at press time, which would be impressive. But seeing as how ether gained over 4,000 percent in 2017 alone, it’s hard to imagine the coin won’t have a similarly parabolic performance in 2018 as retail and institutional interest in Ethereum reaches critical mass.

Consider how Google searches for “Coinbase” are totally exploding right now, for example.

And What About Long-Term Price

Well, let’s get really speculative. Let’s Bitcoin one day reaches the market cap of gold at press time, which is approximately $8 trillion.

8 trillion divided by 21,000,000 bitcoins = a BTC price point around $380,952.38 USD each. Woah!

Okay, then let’s say — just for the hell of it — that the BTC/ETH ratio stays the same between now and then (which would never happen, but this is just for loose illustration purposes).

The BTC/ETH ratio is hovering around 0.05 right now, so 0.05 x $380,952.38 = a ~$19,050 ETH price.

Now, remember: that’s just an extremely casual guesstimate based off of one conceivable scenario. But it does illustrate that ETH could have some major gains in the long-term. It just depends on how well the project takes off between now and then.